Trump's inauguration looks to have kept traders distracted as markets experienced a relatively quiet Friday, despite some higher volume trading.

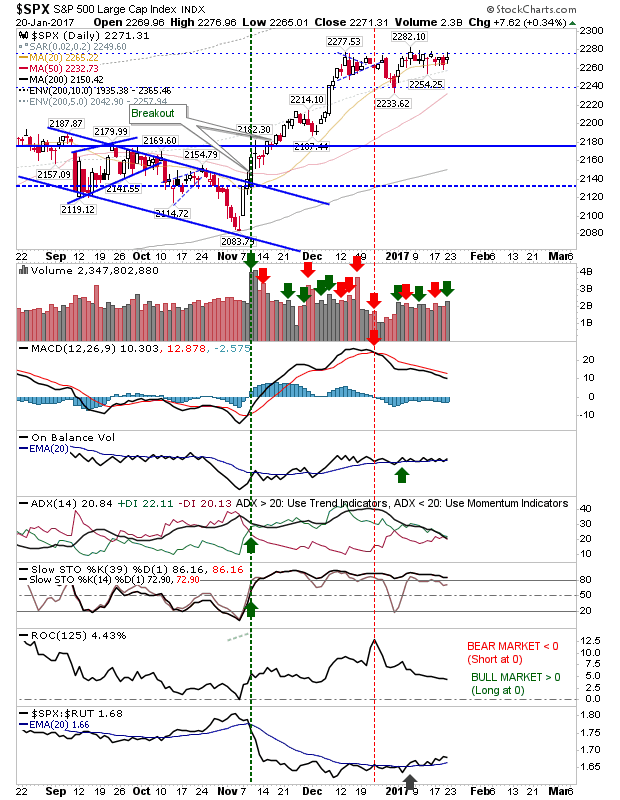

The S&P experienced higher volume accumulation but was unable to get past 2,275. Monday is another day, but keep an eye on the MACD; a gain with a new 'buy' trigger well above the bullish zero line will attract technical traders on the long side. This in turn will encourage short covering.

The Nasdaq turned a MACD trigger 'sell', but given its relative position well above the bullish zero line it would count as a weak 'sell' trigger. Other Technicals remain firmly positive, and the relative performance of the index against the S&P suggests it's well positioned to go higher.

Meanwhile, the Russell 2000 is still struggling. It did make up some lost ground, but not enough to recover lost support and not enough to reverse technical weakness. Shorts will again be looking to attack unless there is a push above 1,376.

Longer term charts had moved back in favour of bulls (in what was a slow-mo reversal). It would take a few months of consistent downside to return this to a bearish stance; in light of this, look for a move to broadening wedge resistance - i.e. further bullish action.

Dow Theorists can continue to take comfort in the relative relationship between Transports and Dow Jones as the breakout from the two-and-a-half year decline resumes its upward advance (Transports leading).

For tomorrow, watch for a breakout in the S&P and a continuation (with new highs) of a breakout in the Nasdaq. A weak start could see an acceleration down in the Russell 2000.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for

ChartDNA.com, and Product Development Manager for

FirstDerivatives.com. I also trade on

eToro and can be copied for free.