Small Caps Continue To Feel Pain

It was an odd day. Early gains were quickly erased, but some markets managed to regain some lost ground by the close. The Russell 2000 experienced the worst of the action and is finding it hard to attract buyers. The next milestone is the 25% discount from highs at 972, then the measured move lower at 951.

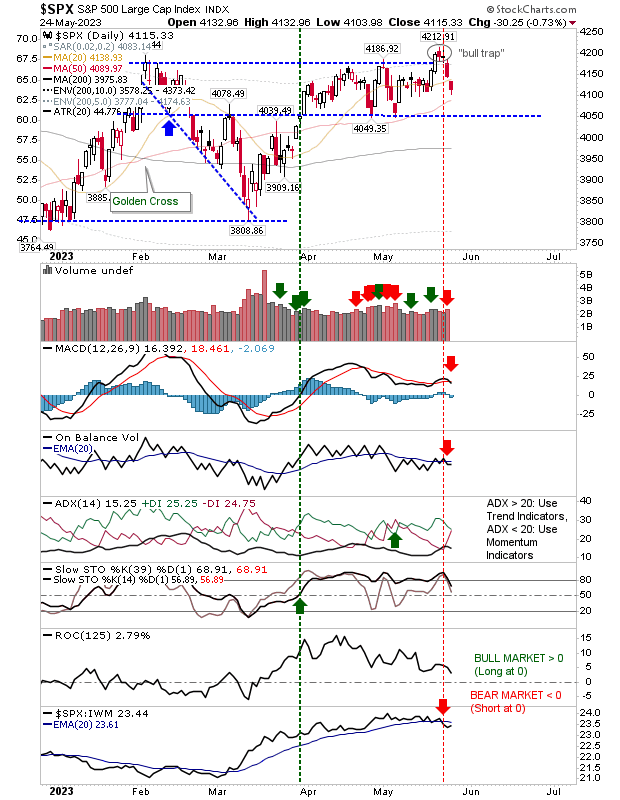

The S&P held to a more neutral spinning top, clinging to 1,875 support. The index continues to make strong relative gains against Small Caps, but it could do with mounting a rally to relieve the pressure. An undercut of 1,875 opens up for runaway losses, this despite oversold conditions.

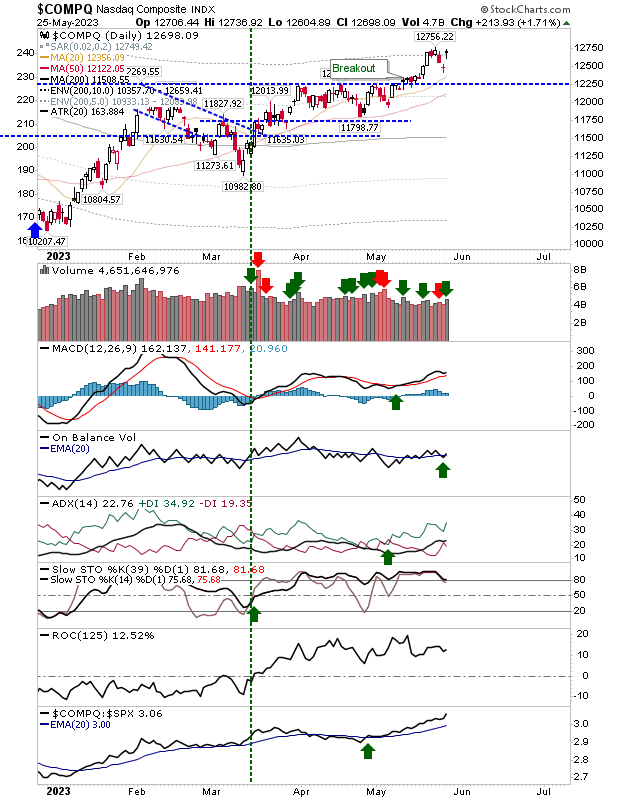

The Nasdaq is holding to August low, but is experiencing similar relative losses as the Russell 2000 against the S&P. The index is close to completing a 'Death Cross' between 50-day and 200-day MA to negate what is increasingly looking like a 'bull trap' from the December 'Golden Cross'. Volume was relatively light, not capitulation volume - yet.

The history of spikes in the $VXN suggests there is probably another month of 'fear' / selling before a bottom emerges.

For tomorrow, watch for early action gap losses. Knife catchers may look to try again in the morning and bears will look to break things in the first half hour of trading. Long term buyers shouldn't fret and keep researching for opportunities and/or take nibbles at index funds/ETFs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P held to a more neutral spinning top, clinging to 1,875 support. The index continues to make strong relative gains against Small Caps, but it could do with mounting a rally to relieve the pressure. An undercut of 1,875 opens up for runaway losses, this despite oversold conditions.

The Nasdaq is holding to August low, but is experiencing similar relative losses as the Russell 2000 against the S&P. The index is close to completing a 'Death Cross' between 50-day and 200-day MA to negate what is increasingly looking like a 'bull trap' from the December 'Golden Cross'. Volume was relatively light, not capitulation volume - yet.

The history of spikes in the $VXN suggests there is probably another month of 'fear' / selling before a bottom emerges.

For tomorrow, watch for early action gap losses. Knife catchers may look to try again in the morning and bears will look to break things in the first half hour of trading. Long term buyers shouldn't fret and keep researching for opportunities and/or take nibbles at index funds/ETFs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!