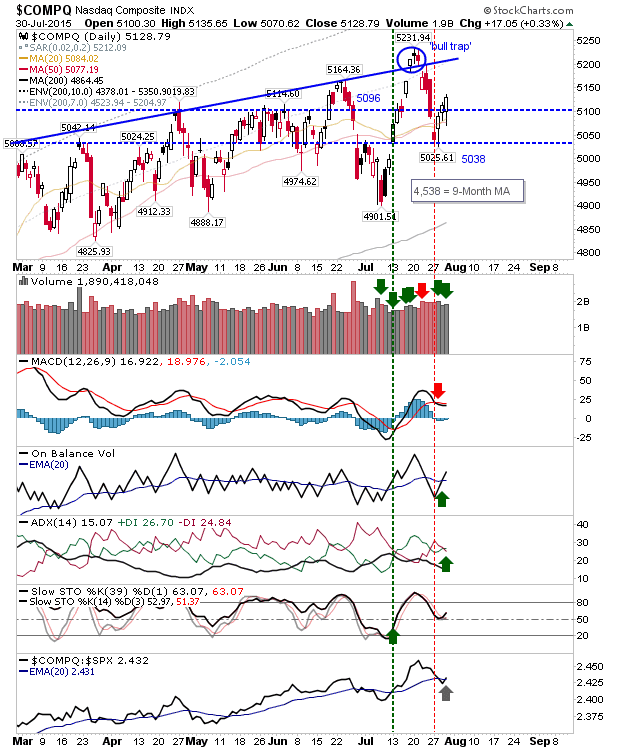

Markets Remain Near and Above, Yesterday's Highs

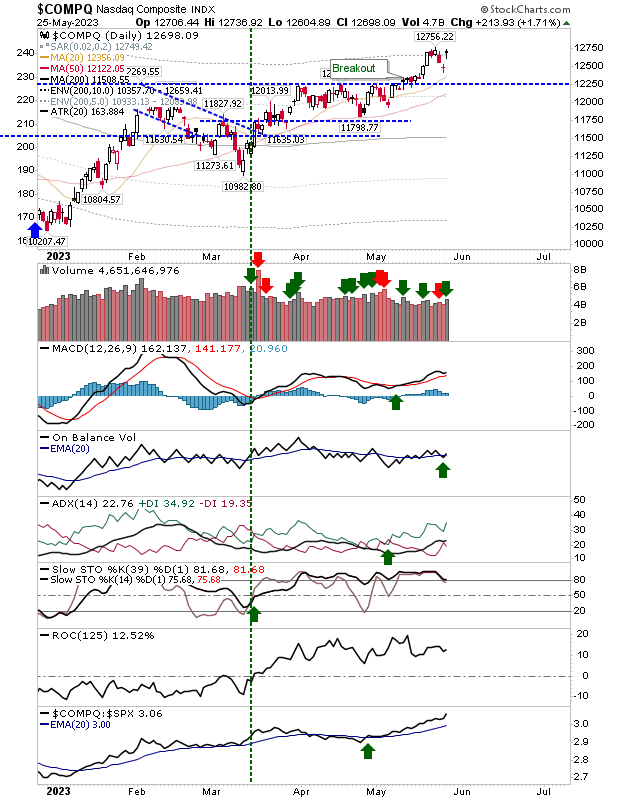

Tech indices finished strong after they overcame the opening half hour of selling. The Fed statement was greeted favorably, although market breadth is not looking pretty. The Nasdaq still has a distance to travel to make back all of its losses, but has done well to hold up against Semiconductor weakness.

The Semiconductor Index is struggling to make inroads against past losses as the Nasdaq and Nasdaq 100 push respectable gains. I find it hard to see how this scenario can continue, but given the dominance of Google, Apple and Microsoft in the weightings, it's easy to see how tech indices have diverged from Semis.

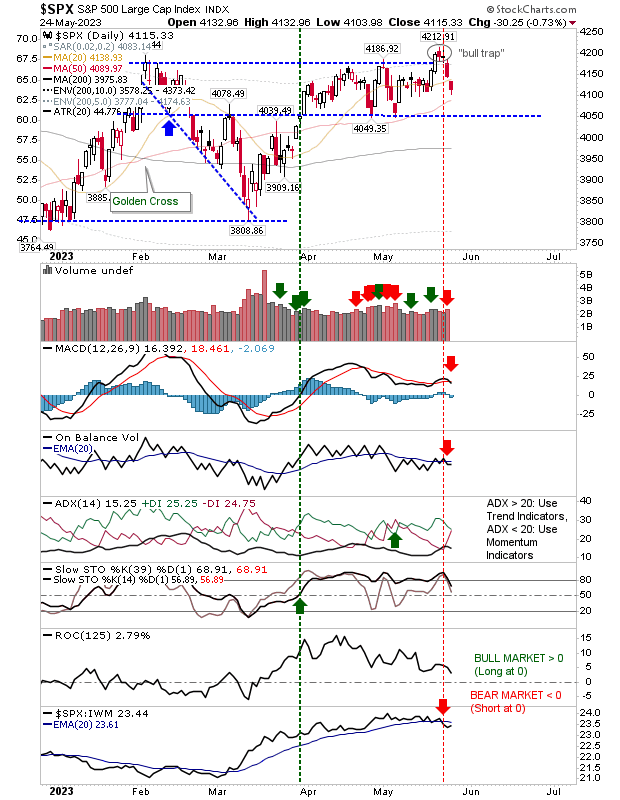

The S&P wasn't able to take out yesterday's high, but did enough to recover the morning loss. Tomorrow offers a chance to push a challenge of 2,132.

The Russell 2000 is right on former support, turned resistance. Shorts have their pick for tomorrow.

Markets need an air clearing storm of selling to reset the bull market counter. Market breadth suggests it's coming soon, but price action continues to defy. Until then, ride the winners and don't be afraid to take profits.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Semiconductor Index is struggling to make inroads against past losses as the Nasdaq and Nasdaq 100 push respectable gains. I find it hard to see how this scenario can continue, but given the dominance of Google, Apple and Microsoft in the weightings, it's easy to see how tech indices have diverged from Semis.

The S&P wasn't able to take out yesterday's high, but did enough to recover the morning loss. Tomorrow offers a chance to push a challenge of 2,132.

The Russell 2000 is right on former support, turned resistance. Shorts have their pick for tomorrow.

Markets need an air clearing storm of selling to reset the bull market counter. Market breadth suggests it's coming soon, but price action continues to defy. Until then, ride the winners and don't be afraid to take profits.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!