Daily Market Commentary: Mixed Day

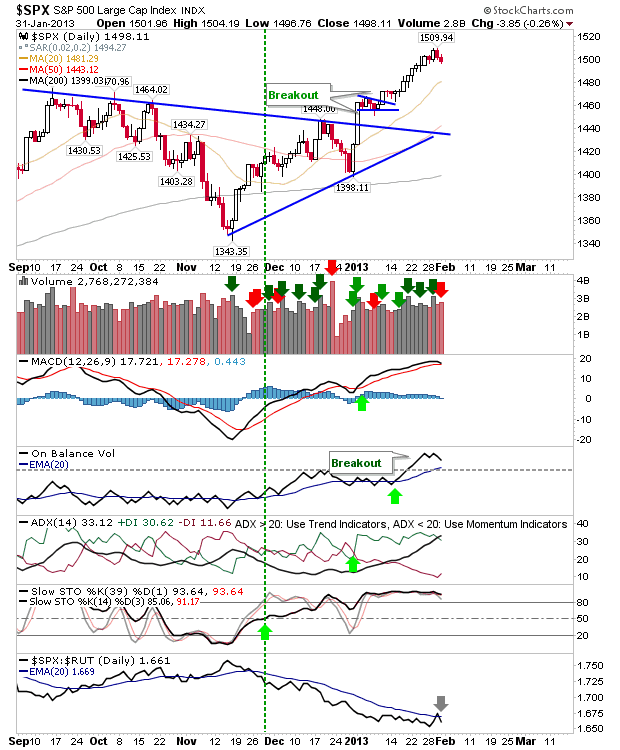

An odd day for the markets with a mix of gains (Russell 2000) and losses (anything else!). Volume climbed to register distribution for the Nasdaq, Nasdaq 100 and S&P, but given the degree of loss it's more like churning than hard defined selling.

The S&P sharply reversed its relative gain against the Russell 2000, but is close to a MACD trigger 'sell'.

The loss in the S&P was offset with a gain in the Russell 2000, although this index had the greatest loss yesterday. The gain in the Russell 2000 wasn't enough to reverse the 'sell' in the MACD.

The Nasdaq finished effectively flat, but trading volume was particularly heavy. This volume spike contributed to an increased loss in On-Balance-Volume, which builds on the MACD 'sell' trigger.

The net effect of today was better for bulls. Despite heavier volume, the selling was unable to push the market significantly lower. Also, the more speculative Small Cap stocks managed gains and swung the market away from defensive Large Caps. The market needs a substantial pullback to balance the gains, but it may still be a little early for it (despite the heavily overbought nature of the market)

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P sharply reversed its relative gain against the Russell 2000, but is close to a MACD trigger 'sell'.

The loss in the S&P was offset with a gain in the Russell 2000, although this index had the greatest loss yesterday. The gain in the Russell 2000 wasn't enough to reverse the 'sell' in the MACD.

The Nasdaq finished effectively flat, but trading volume was particularly heavy. This volume spike contributed to an increased loss in On-Balance-Volume, which builds on the MACD 'sell' trigger.

The net effect of today was better for bulls. Despite heavier volume, the selling was unable to push the market significantly lower. Also, the more speculative Small Cap stocks managed gains and swung the market away from defensive Large Caps. The market needs a substantial pullback to balance the gains, but it may still be a little early for it (despite the heavily overbought nature of the market)

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!