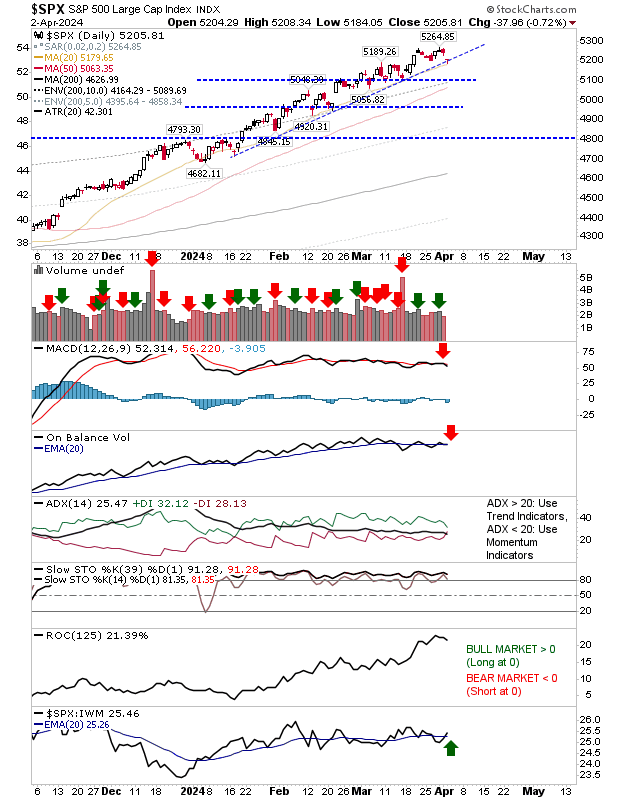

Russell 2000 ($IWM) "ascending triangle" squeeze, with the Nasdaq and S&P struggling

If there is a swing trade with plenty of tension ready to snap, it's in the Russell 2000 ($IWM). The index looks poised to either negate the late March 'bull trap', or crack below ascending triangle support with a big, red candlestick. Technicals still favor bulls, although the earlier MACD trigger 'sell' is a bit of a concern; note, MACD 'sell' triggers that occur above the MACD zero line are at best, weak 'sell' signals - often a good time to sell covered calls rather than offload a position. On-balance-volume continues to trend higher, and momentum as measured by stochastics is firmly above the 50 mid-level.. If there is a break of the trendline, then look for a move back to $187-189 in a likely continued evolution of a time-based, sideways consolidation. It's a bit of a different story for the Nasdaq as it returns to its breakout price on a move to challenge its 'bull trap'. This index has already broken trendline support, and