Weekly charts offer optimism, but there was a weak finish for indices on Friday

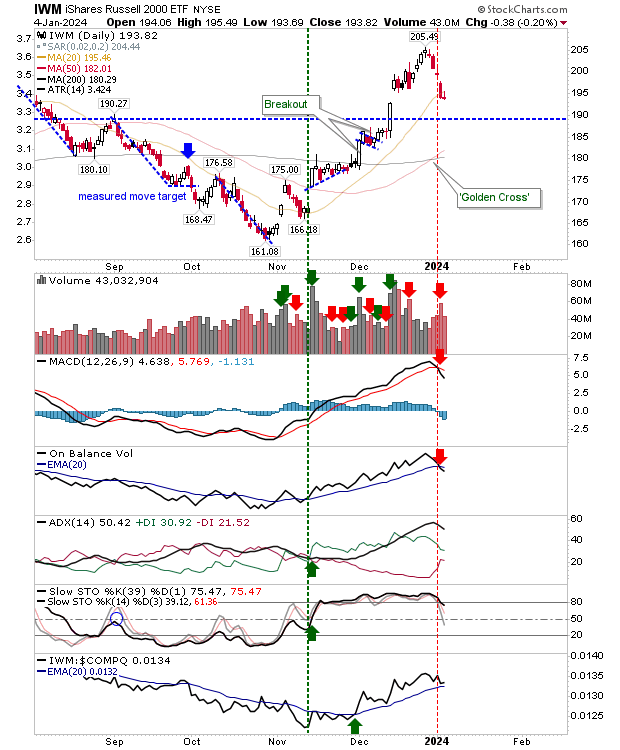

The good work of bulls was done early in the week but rallies had run out of steam by Friday's close, although the weekly charts still look good. On weekly timeframes there was registered accumulation for the S&P and Nasdaq but not for the Russell 2000 ($IWM). The Russell 2000 ($IWM) did close with a doji on the weekly timeframe and in a position to suggest a bullish (reversal) harami cross while also resting near support of $195.