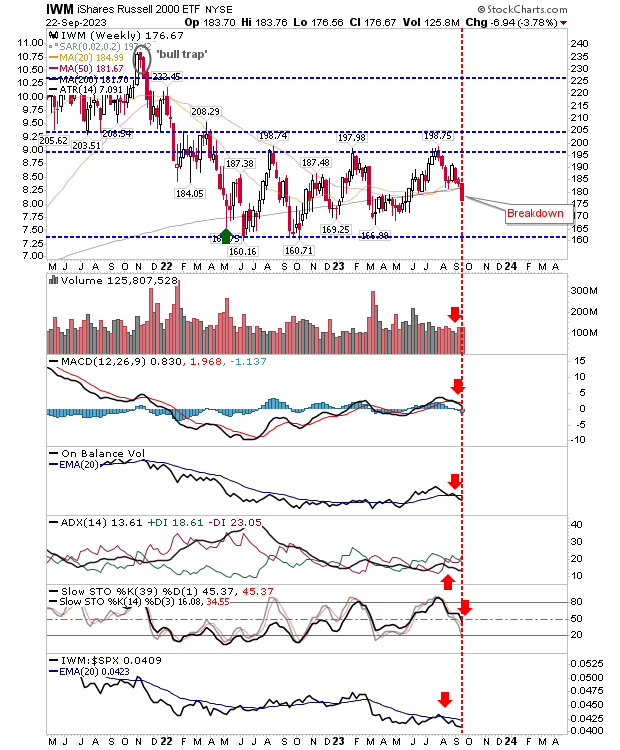

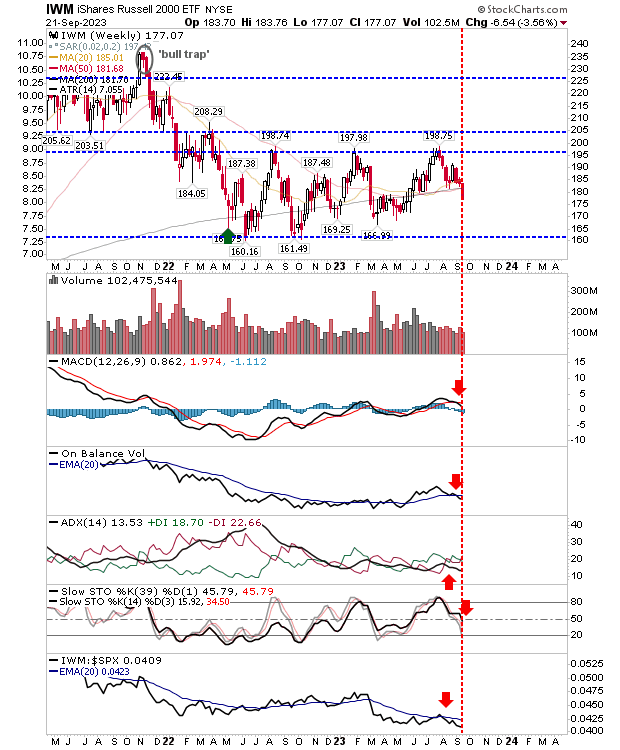

The Russell 2000 sells off hard on volume distribution

The Russell 2000 ($IWM) is the canary in the coal mine for markets and today's action is not great news for the S&P and Nasdaq, despite the latter indices doing 'okay' today. Selling volume rose to rank as distribution with a 'sell' trigger for On-Balance-Volume. Relative performance accelerated in its decline against the S&P (and Nasdaq), but this has been the case since August. The only positive is the residual MACD 'buy', but this signal occurred well below the MACD zero line, not a good trade signal and one liable to fake out.