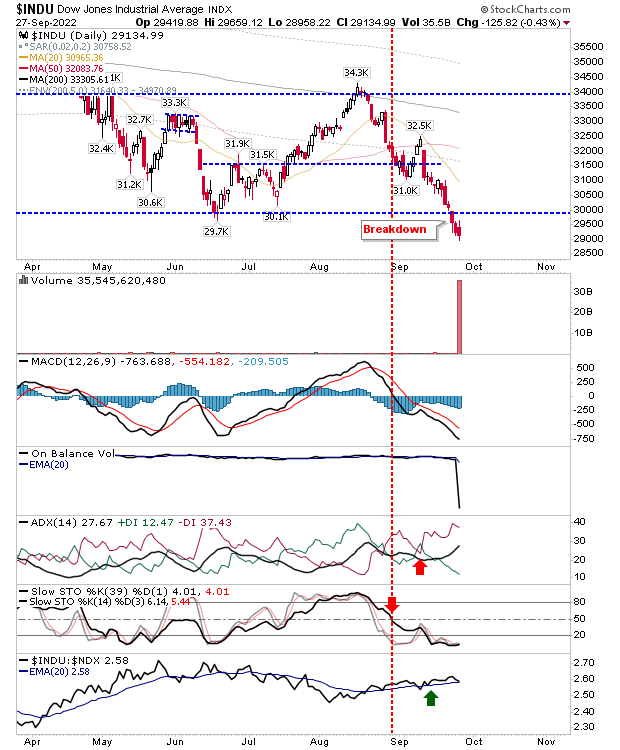

Selling inevitable, but Russell 2000 retains support

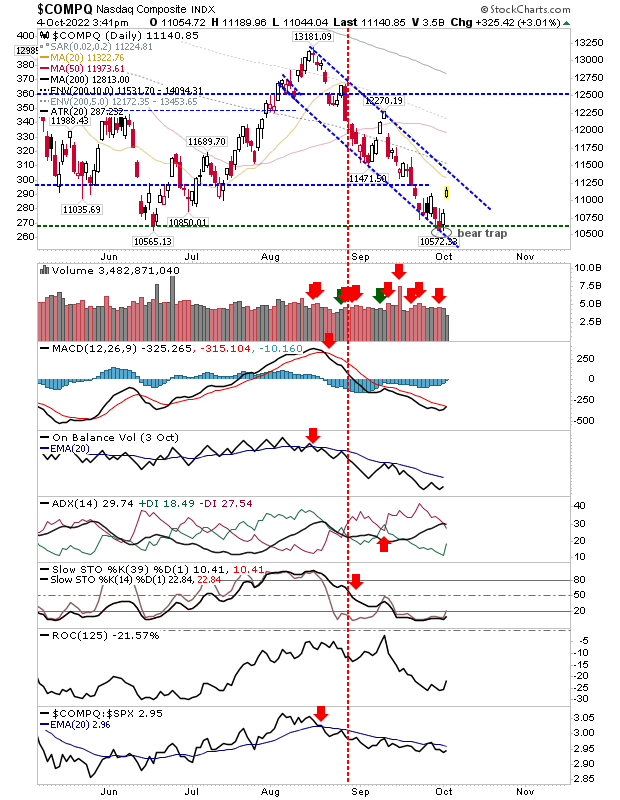

Big bullish engulfing patterns from Thursday were going to struggle to hold their gains, particular as many had started from below support established by the June swing low, and all had come on the back of two months of selling. With the Nasdaq, the selling had pushed down to half the height of the engulfing pattern and returned the MACD to a 'sell' trigger. Other technicals continue to worsen, but at least selling volume was down on the previous day's accumulation.