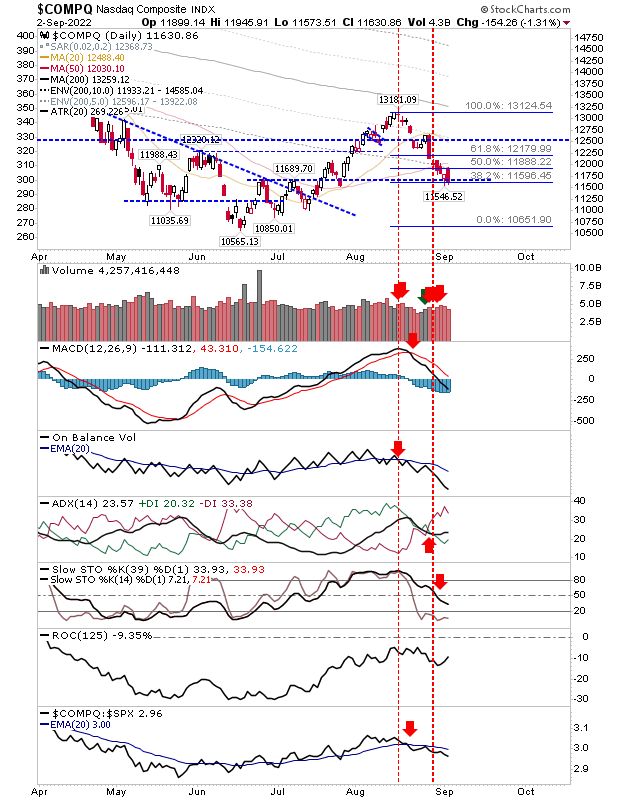

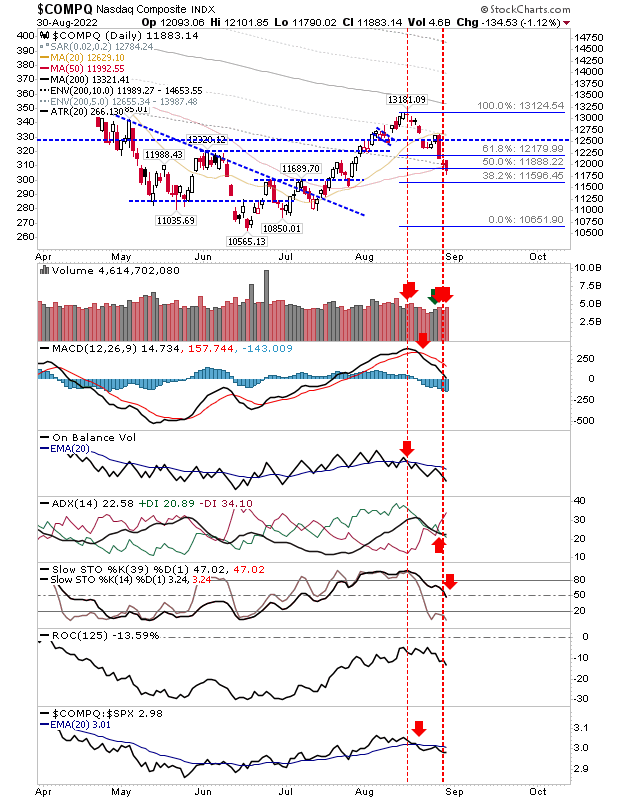

Four straight days of gains on falling volume

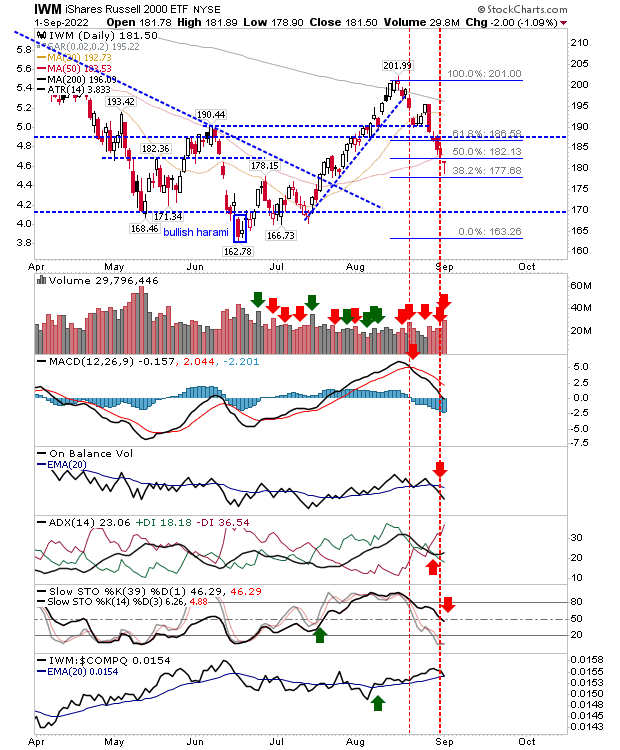

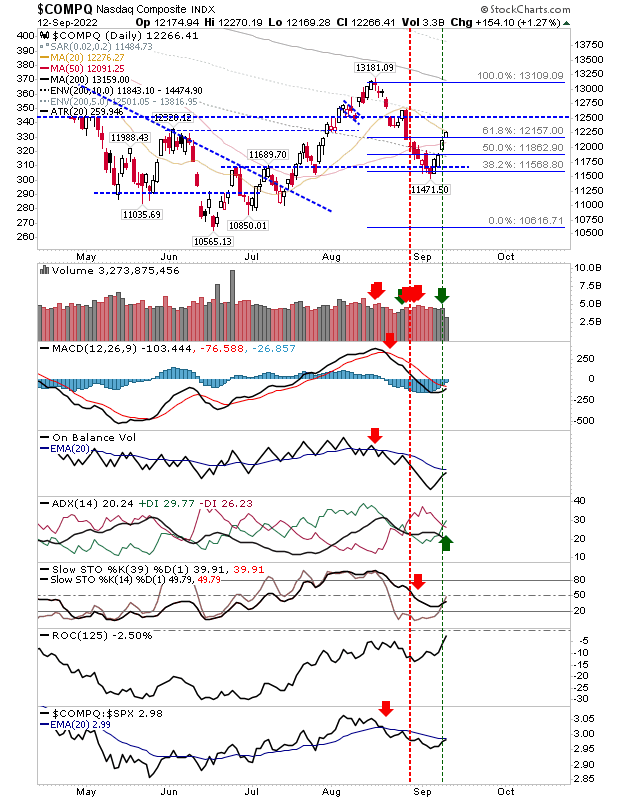

This bounce has gone through 50-day MAs and is now challenging 20-day MAs for the S&P, Nasdaq and Russell 2000. Since the swing low was established last week indices have rallied without pause. At this stage, we would want to see how markets react to when sellers return. For the early part of the day it looked like we were going to get that mini-top reversal candlestick, but instead, all indices were able to close at highs. Gains in the Nasdaq were enough to see a 'buy' trigger in the ADX, although there is still need for a few more days of gains before technicals turn net positive - something we may not see. The index is also underperforming relative to the S&P, but is close to a signal crossover in this regard (towards outperformance).