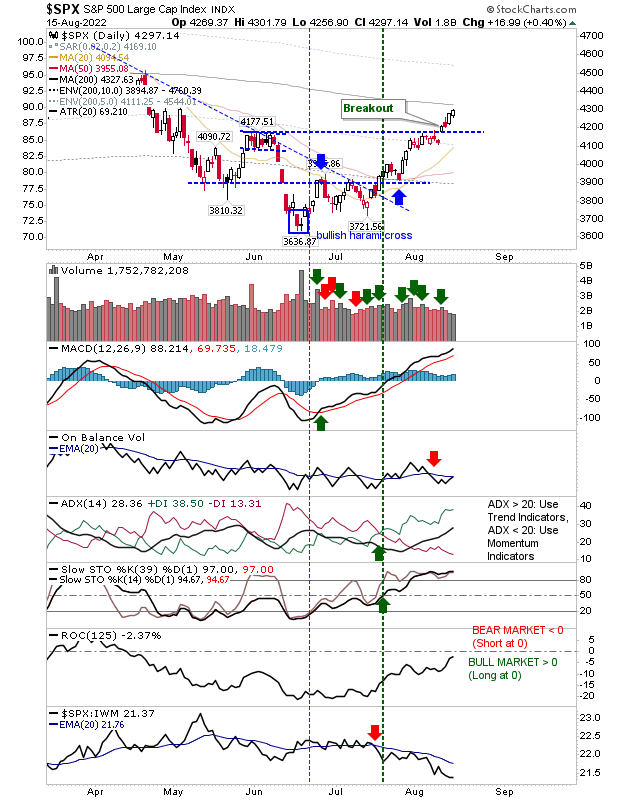

S&P on verge of bull cross of 200-day MA

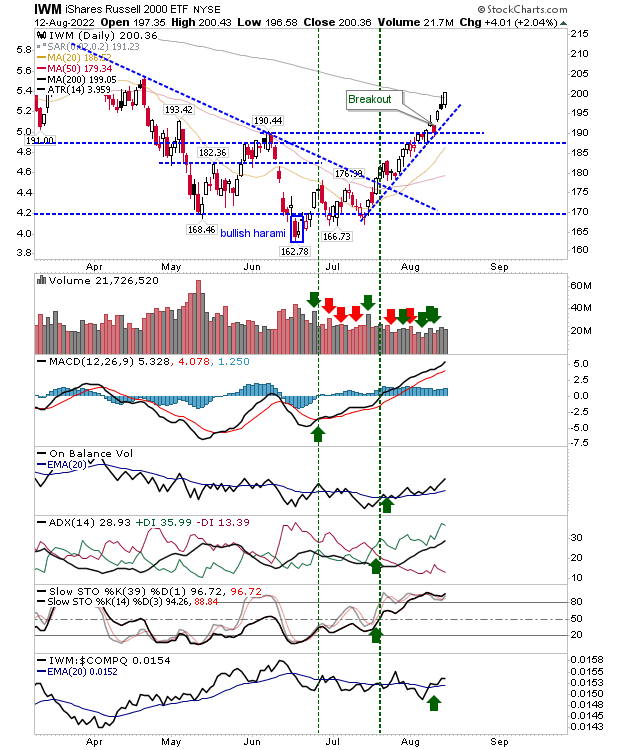

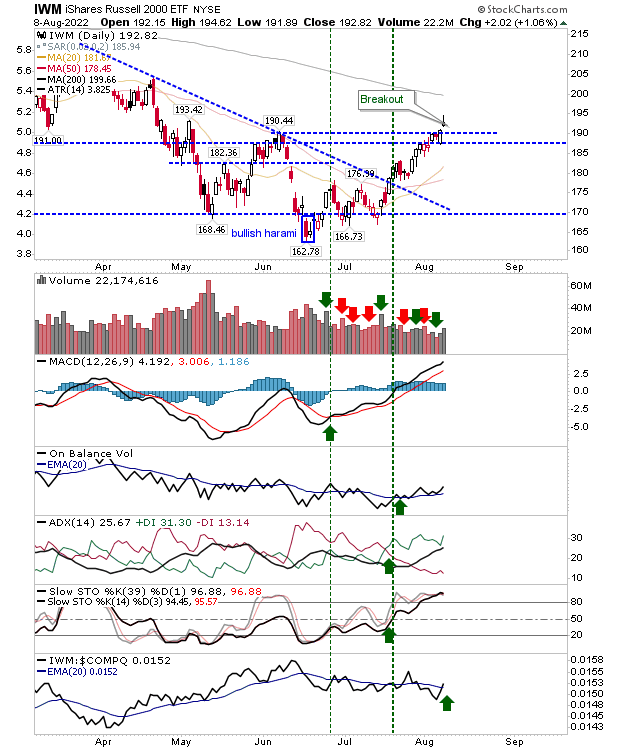

A solid start to the week, albeit on light volume. Last week saw the bullish cross of the 200-day MA in the Russell 2000. This week started with the S&P fast approaching its 200-day MA and could be testing it tomorrow. The S&P is also on the verge of a fresh cross in On-Balance-Volume, although the relative performance of the index to its peers took a step in the other direction - but this shouldn't distract what is positive, bullish action.