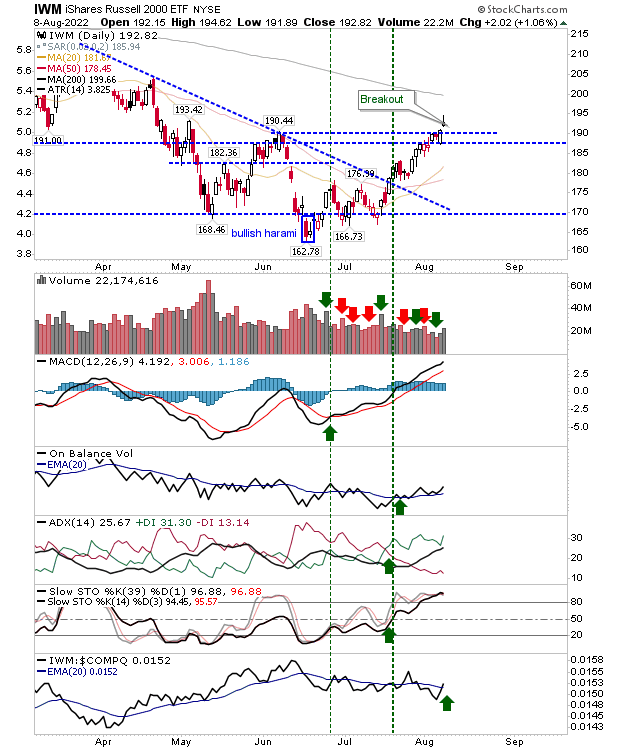

Indices finish week on a high

Friday was a solid day for indices with the Russell 2000 ($IWM) doing enough to push through its 200-day MA despite Thursday's bearish candlestick. Small Cap trading volume remained seasonally light, but Friday's buying was enough to retain the uptick in On-Balance-Volume and the relative performance advantage over both the S&P and Nasdaq. Technicals are net positive as a result. Aside from the lack of a meaningful pullback (test of support), this is solid action for the index.