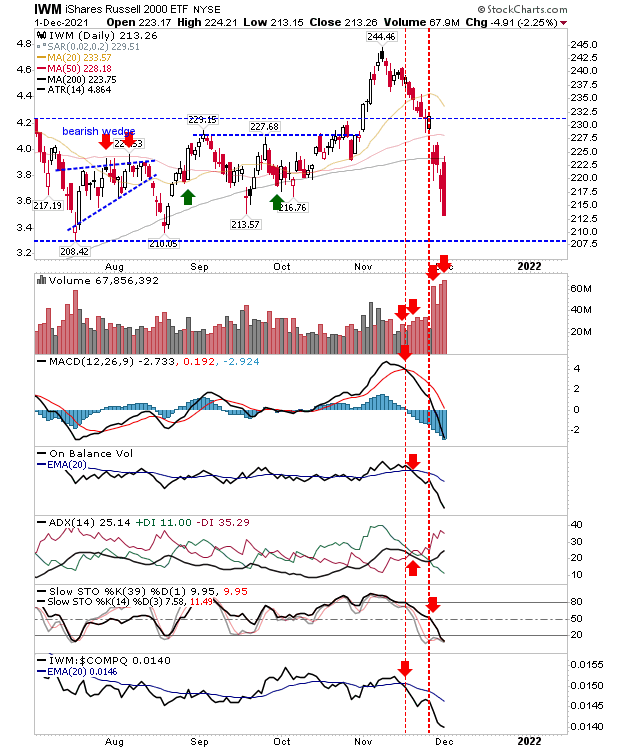

Russell 2000 ($IWM) target of $195

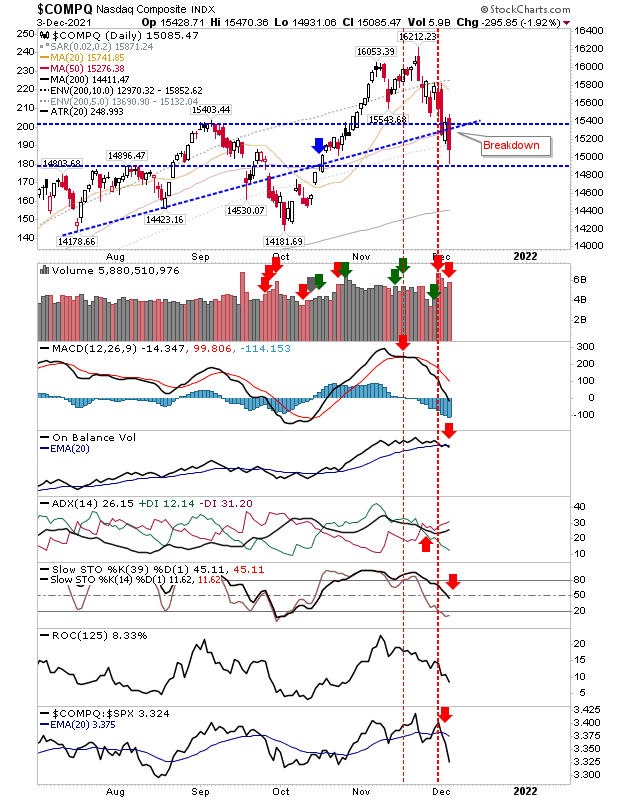

It's looking more likely that we will see measured moves lower across lead indices. The Russell 2000 is the most vulnerable, and has the the deepest measured move target of $195 from the ETF ($IWM). It should be noted, should the Russell 2000 reach this target it would only fall back to where the index traded this time last year, and well above breakout support of $165. The Covid low of 2020 was clearly a good buy (as noted in the tables you see below this article), the next low (if it reached is measured move target) will be another.