Relief buying has potential for more

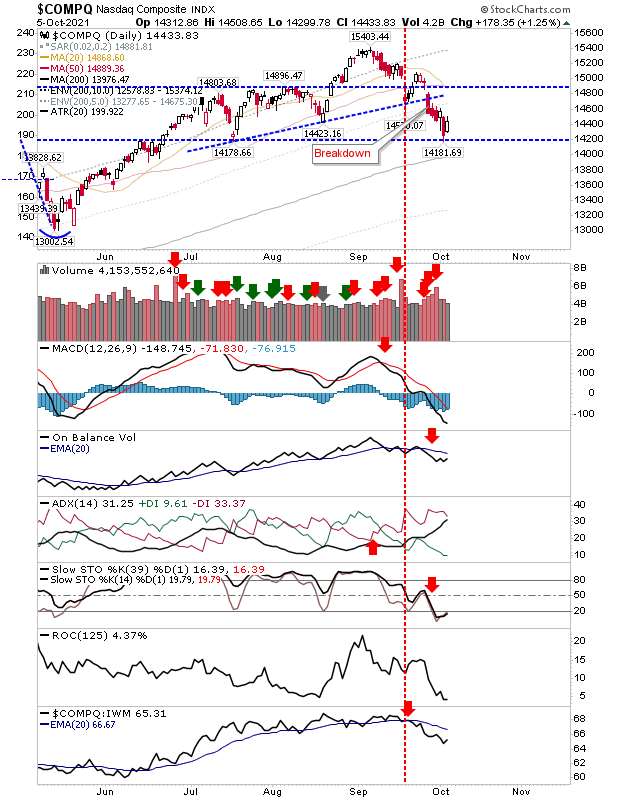

Today's buying was able to erase much of yesterday's losses, although trading volume was below that of Monday. Given the declines in lead indices, what happened today has the potential to act as a swing low - it's just whether nearby 200-day MAs would not prove to be a better point for buyers to come in to support the indices. The Nasdaq rallied from a prior support area - one which also corresponded to the July swing low. Technicals are net negative with a big swing against it when it comes to relative performance against the Russell 2000.