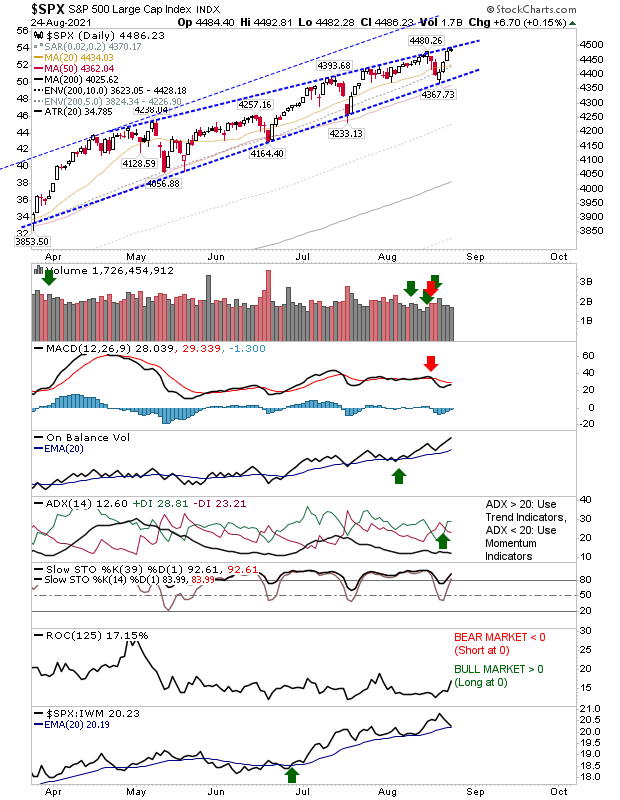

S&P loses accelerate as Dow Industrials confirms 'bull trap'.

We are starting to see a pick up in Large Caps loses as the bearish wedge in the S&P continues its move towards its ultimate resolution. The index now finds itself at its 20-day MA with 'sell' triggers in the MACD and On-Balance-Volume. Expectation is an undercut down to wedge support