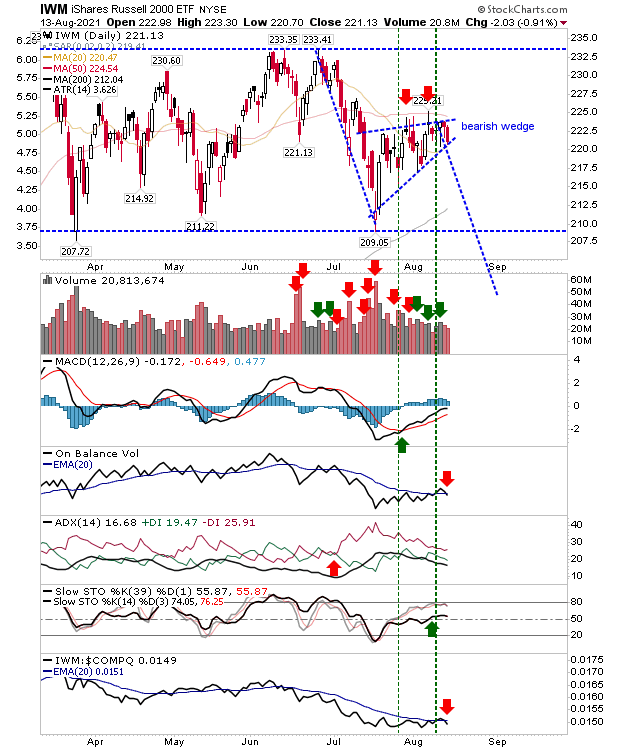

Friday's recovery opens the potential for a swing low in markets

Friday delivered a second gain for markets, enough to open the possibility for new swing lows to develop - although the falls were relatively shallow. The Nasdaq had undercut its 50-day MA on Thursday's gap down before recovering. There is still some work to do before it can challenge its prior highs, but there was also a drop in volume on Friday's gains, which suggests there could be further struggles if gains continue.