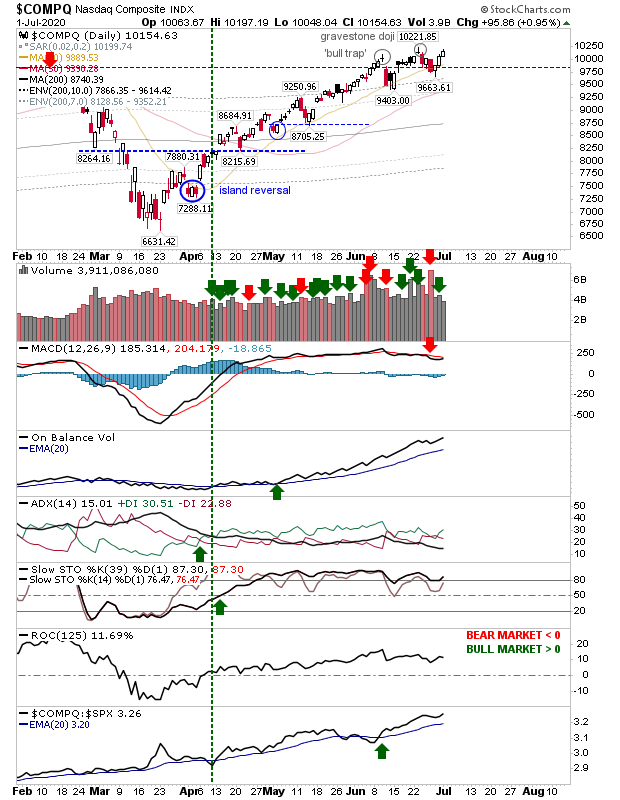

The week ended for markets with sellers in control. The damage was sufficient to put markets on warning for a bearish reversal - but the last such attempt in early June was quickly reversed by buyers; will this time be different? The Nasdaq lost its breakout with a drop below 10,000 and support of 9,800. Part of this move also undercut its 20-day MA. Volume rose in confirmed distribution in one of the heaviest trading days of the year not attributable to options expiration. An effective flat-lined MACD switched to a 'sell' trigger, so this is vulnerable to whipsaw as other technicals remain firmly bullish.