S&P Readies for Breakout

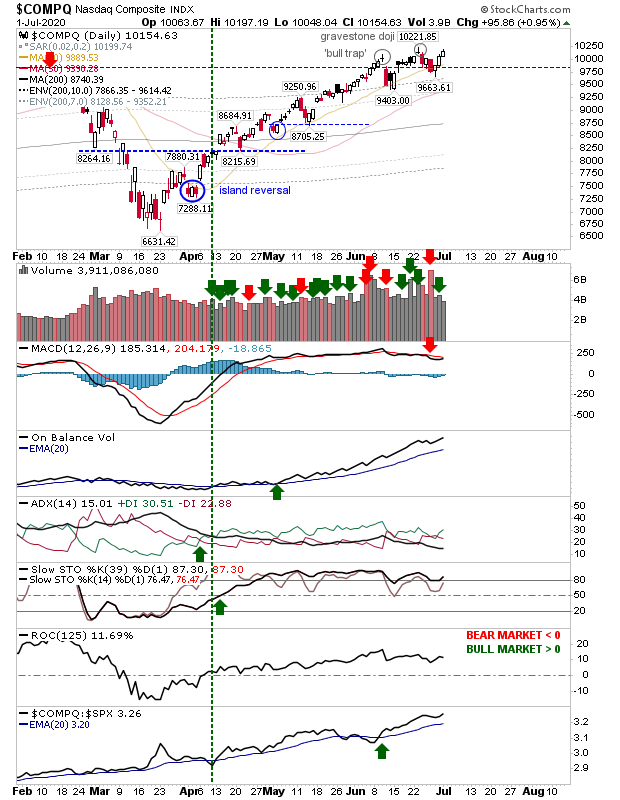

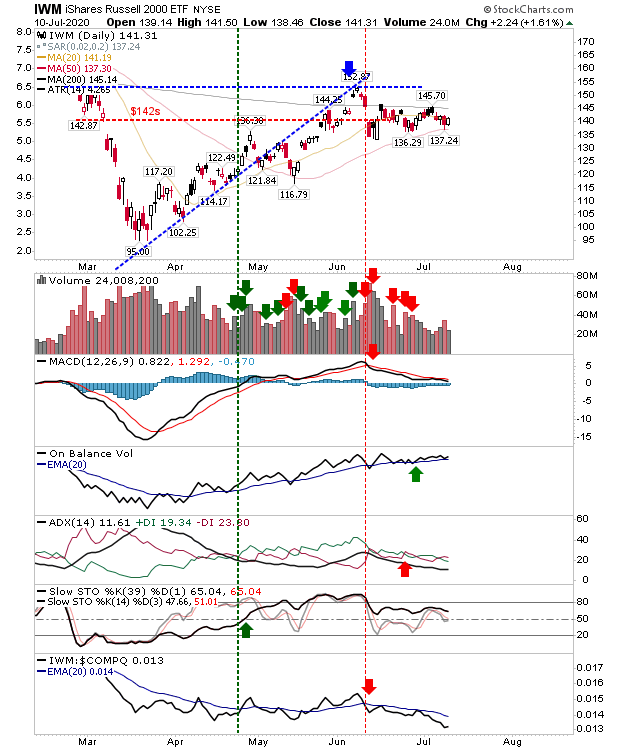

With the week behind us the S&P stood poised to break to new highs for the recovery rally, following the lead of the Nasdaq which is already posting new multi-year highs. The Russell 2000 is looking a little more tentative as it remains below its 200-day MA on bearish MACD, ADX and relative performance.