Small Losses Friday Don't Stop Rallies

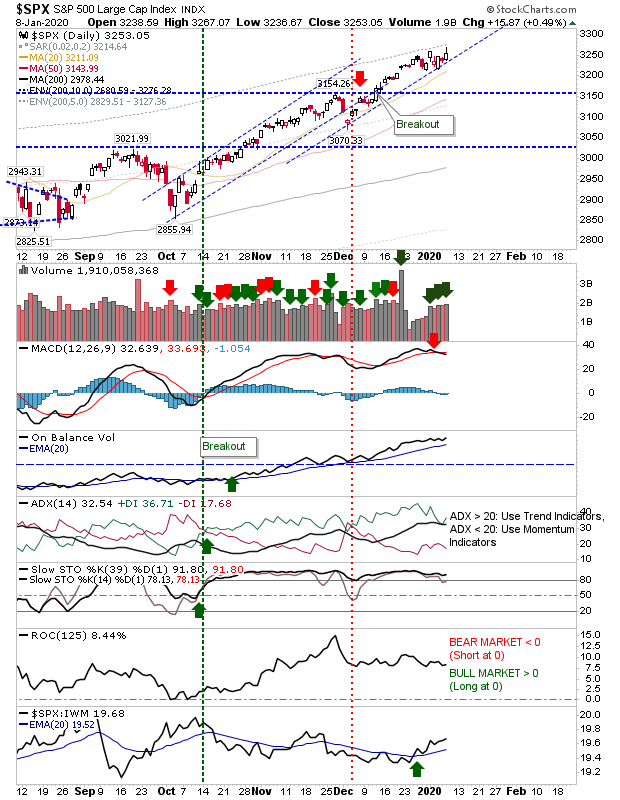

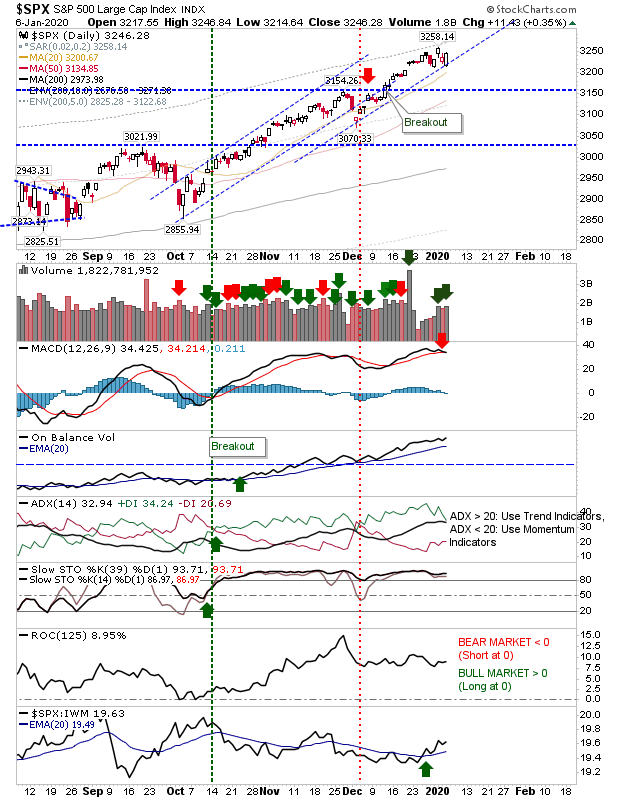

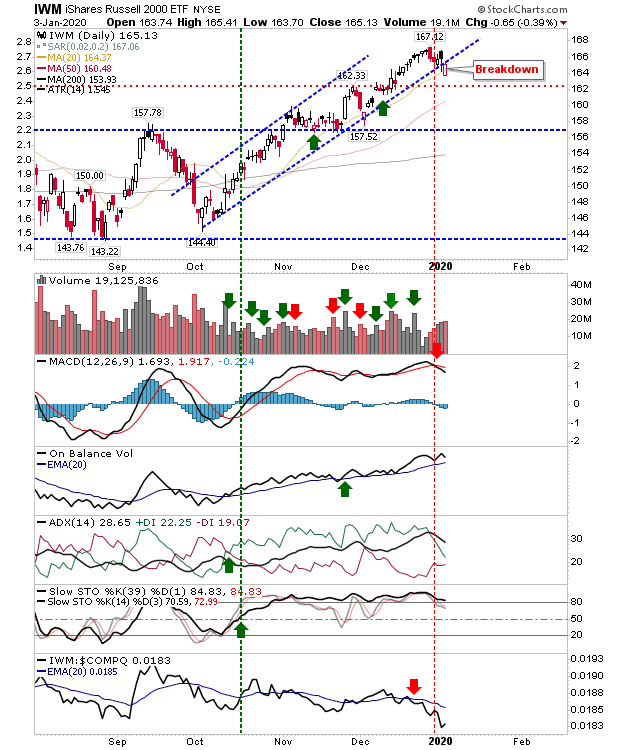

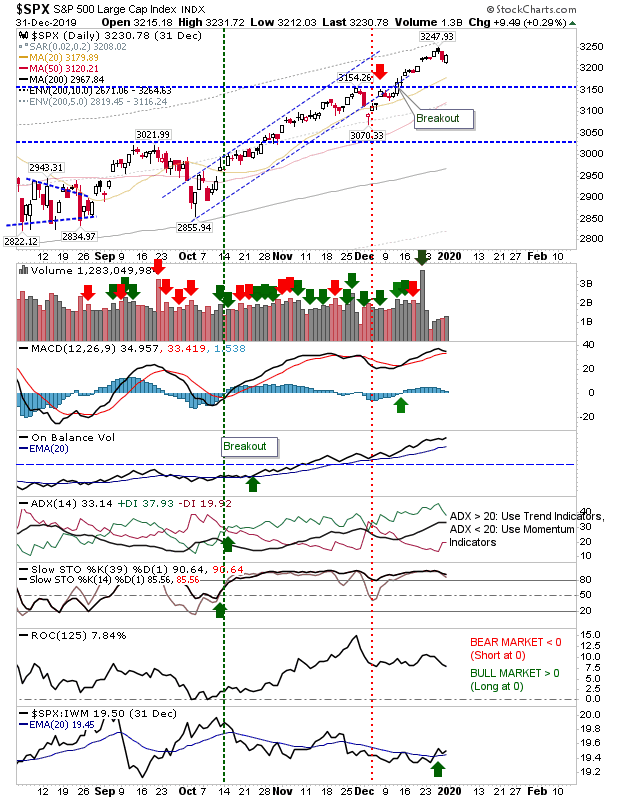

Friday's action saw a small loss against what was a positive week for indices. Volume was light, reflecting a lack of conviction on the part of holders to want to take profits. Although it was probably more a case of a break in buyer activity, for what was a gradual increase in trading volume for 2020 as Traders work their way back from holidays. The S&P remains in good shape as relative performance picks up the pace. The MACD is a little flat but other technicals are looking good.