Happy New Year!

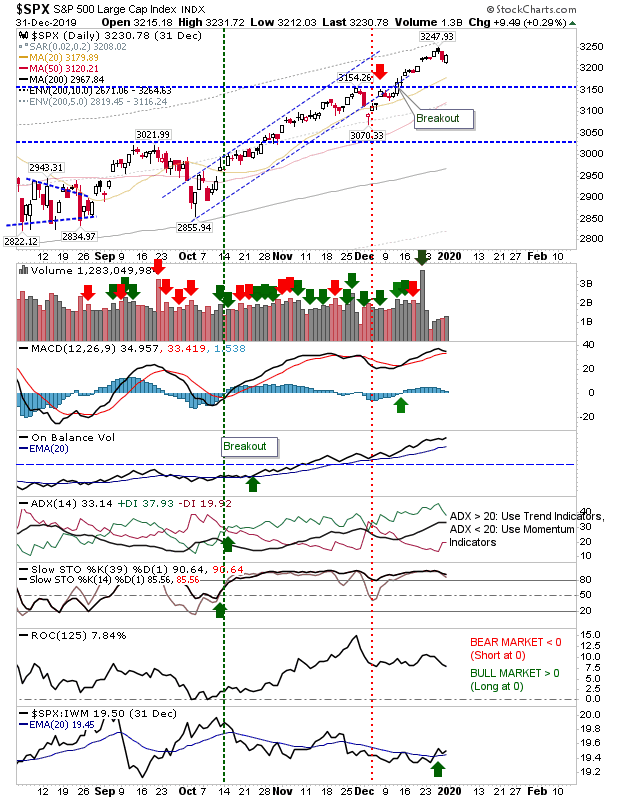

Getting back into the swing of things. I offered a yearly outlook here but this post will focus on the daily charts. It has been more of the same for indices since the pre-Christmas break. Small gains have helped maintain the breakouts established in early December. Volume has been typically light and should pick up into next week. The S&P has continued to hold to its bullish technicals with relative performance now in the ascendancy (versus the Russell 2000).