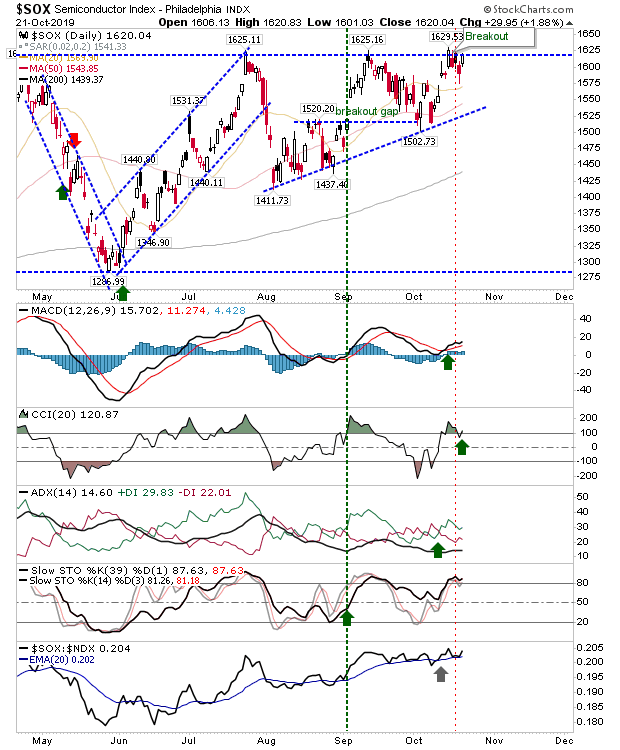

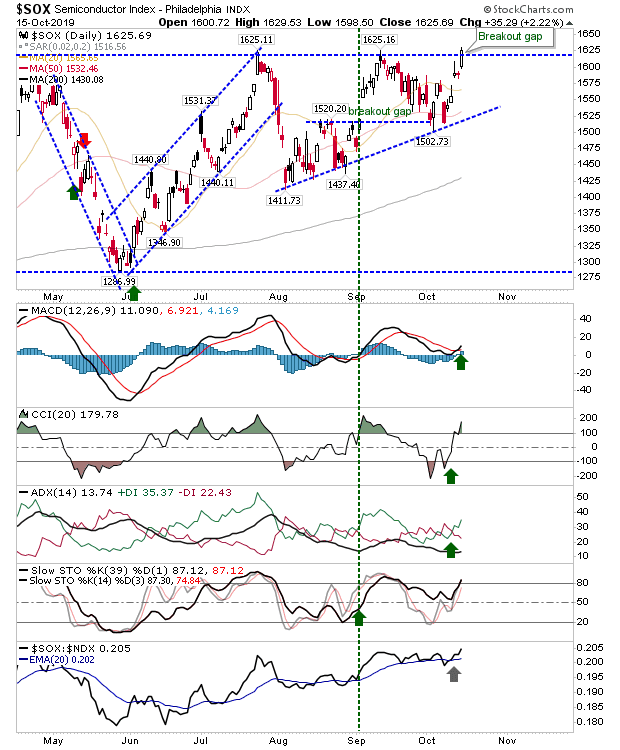

Semiconductors Breakout (Again); Indices Primed to Follow.

It was an excellent Friday for bulls with light volume the only mark against the indices. Semiconductors led the way as after much toing and froing in recent weeks the index finally made a decisive most past resistance. The breakout for the Semiconductor Index came with a solid uptick in relative performance against the Nasdaq 100, although this move should help Tech Indices follow higher.