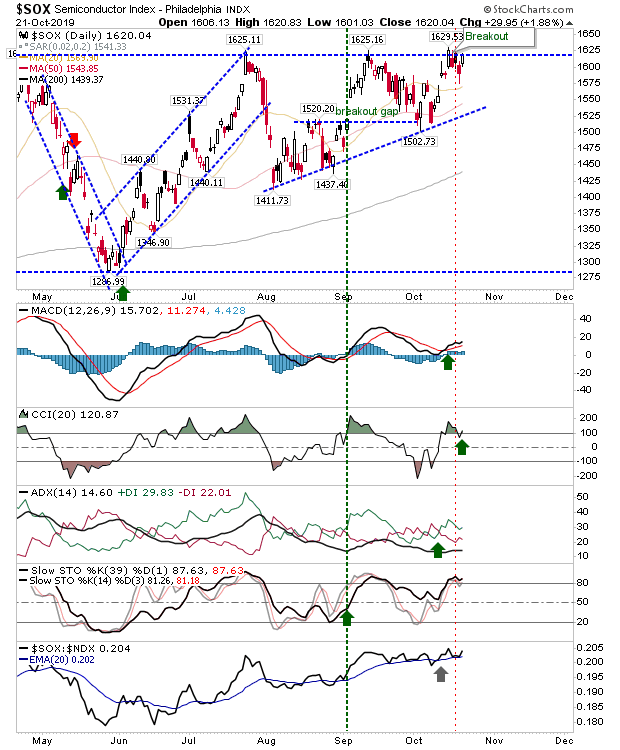

Semiconductors Return Inside The Consolidation

There wasn't a whole lot attached to today's action except for the Semiconductor Index. The Semiconductor Index fell back inside its prior consolidation, falling below 1,620 in a near 2% loss. The Index was able to hold on to support of its 20-day MA on a neutral doji. Relative performance turned negative but the breakout is not killed yes.