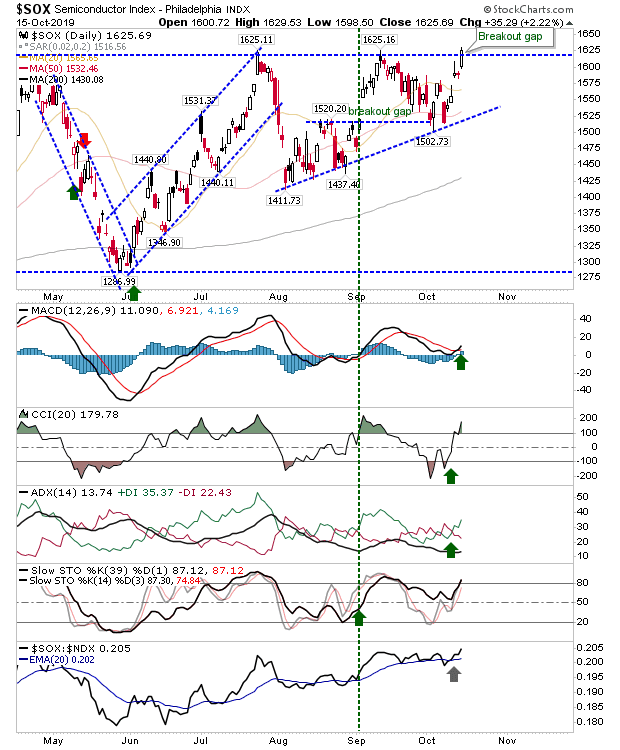

Semiconductors Breakout

There is a potential lead out for other indices with the Semicondictor Index breaking resistance which will help the Nasdaq and Nasdaq 100 mount a challenge of resistance. Large Caps enjoyed higher volume accumulation as money flowed into defensive stocks. With the exception of the Semiconductor Index other indices are still range bound so again, the importance of up or down days won't become apparent until the trading ranges are breached. We will start with the Semiconductor Index. The index has breached 1,625 with a return to net bullish technicals.