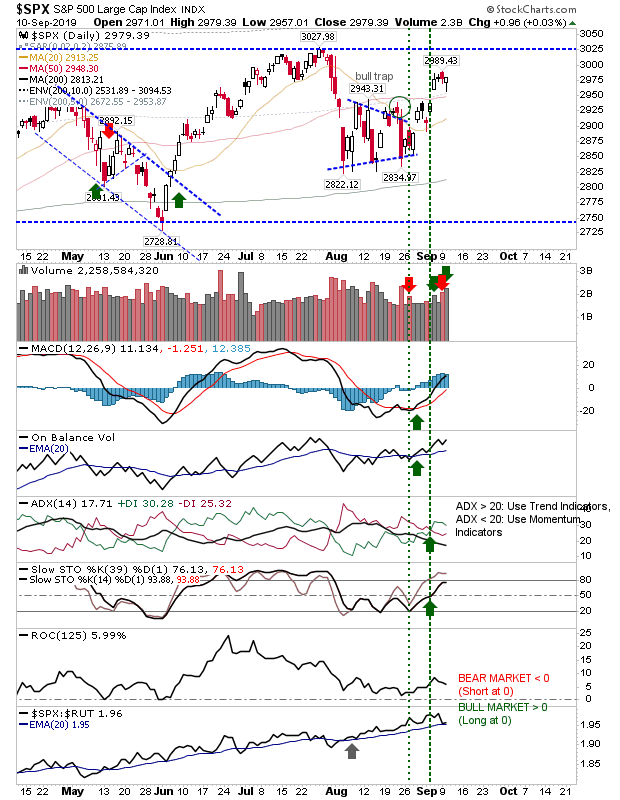

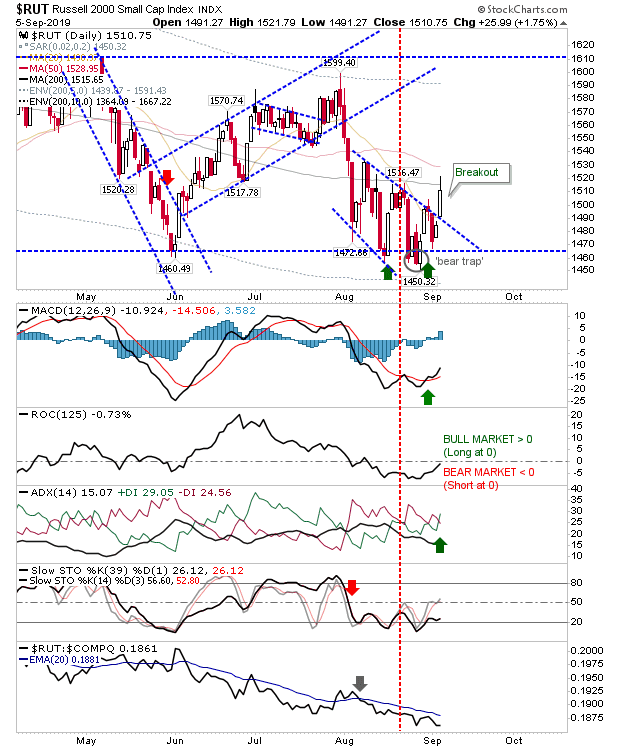

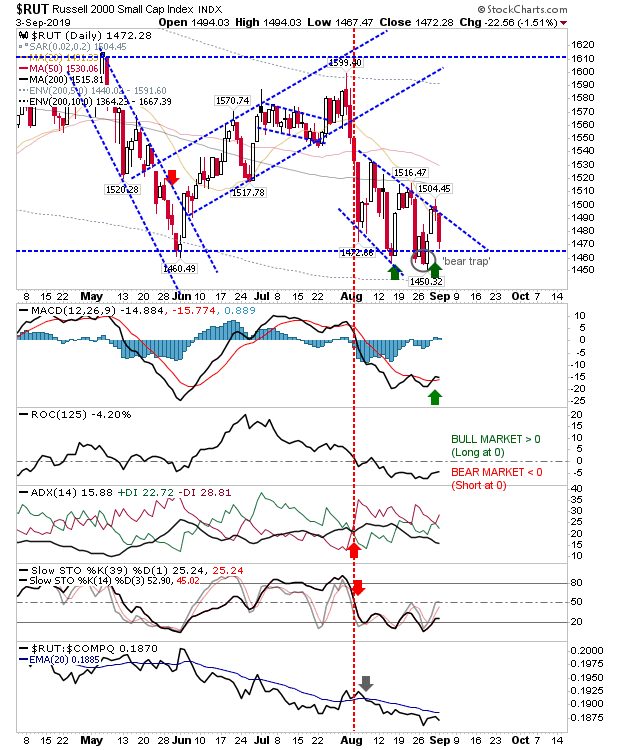

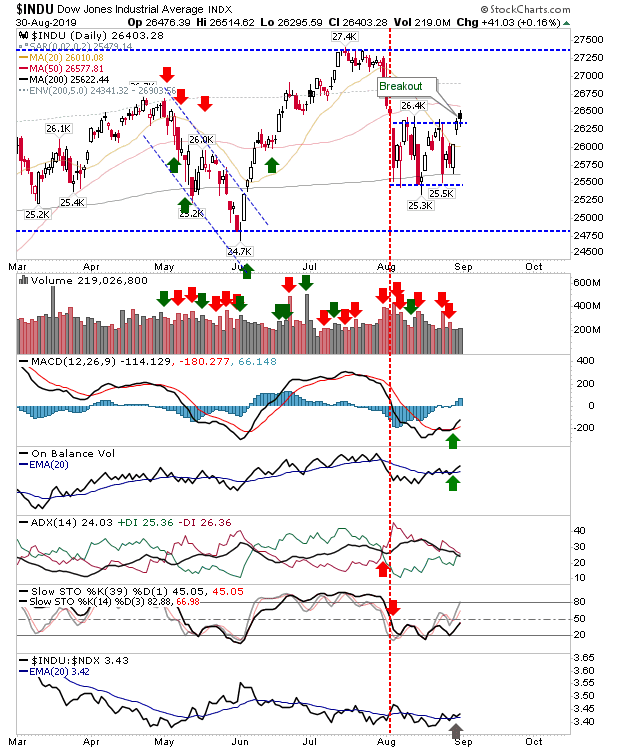

Russell 2000 Makes Big Gains; Semiconductors Challenge 'Bull Trap'

A big day for bulls as two key economically sensitive indices make strong moves. Best of the action was given over to the Russell 2000; a 3.5% gain keeps things buoyant but it's also smack bang in the middle of the trading range.