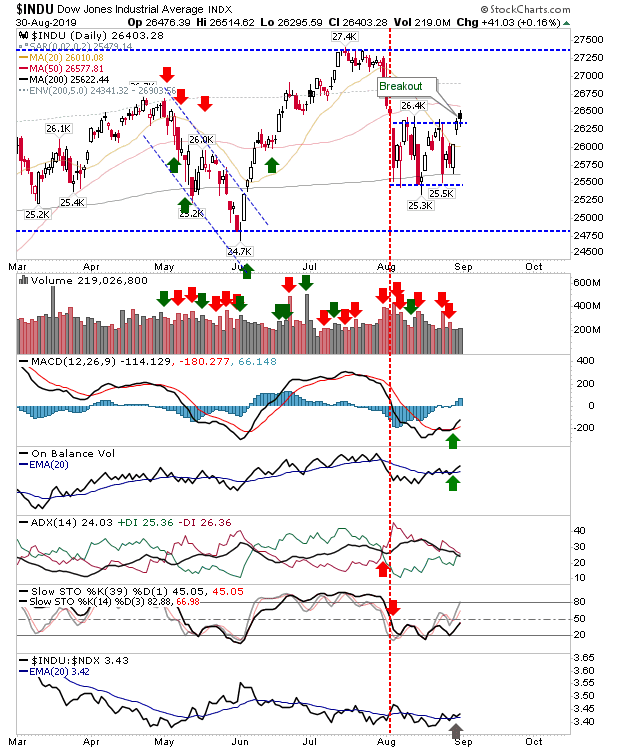

Friday Consolidates Gains For The Week

There wasn't a whole lot to say about Friday's trading. The solid move made over the course of the week across indices was maintained with either small losses or doji. Part of this is because indices are now approaching multi-year highs which will see increased resistance. The S&P posted a small doji as technicals remained net bullish.