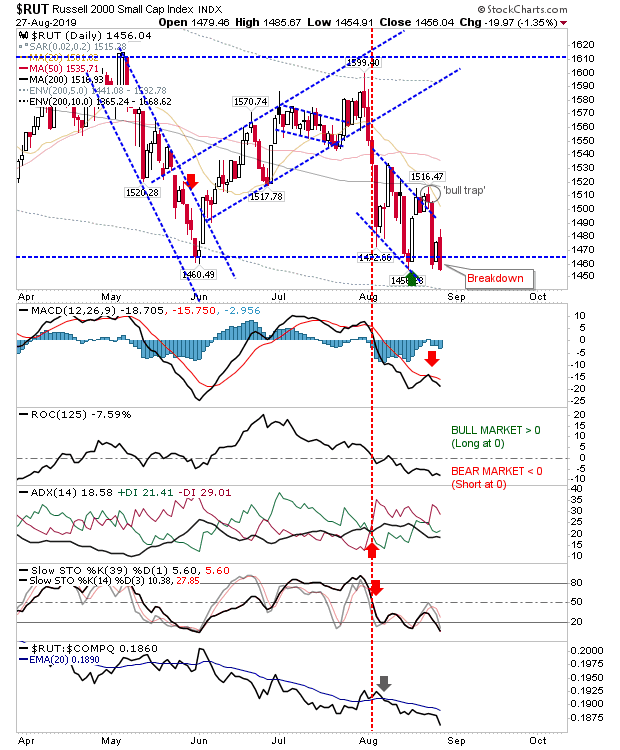

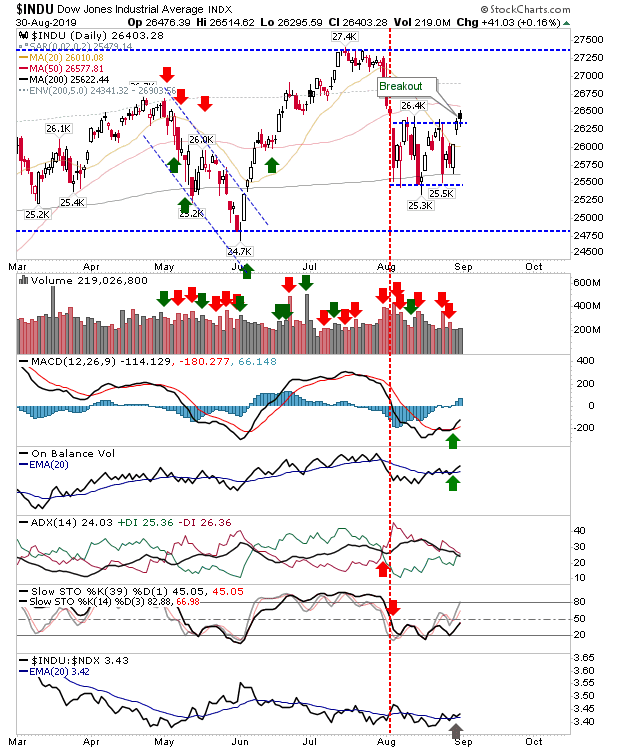

Dow Jones Industrial Index Edges Breakout as Russell 2000 Reverses Off Resistance

There wasn't a whole lot to report from Friday with all indices inside dominant consolidation indices. Best of the action belonged to the Dow Industrial Average as it broke out of its mini-consolidation, nested inside its 2-year consolidation. Again, the larger consolidation is dominant, so the significance of Friday's action is reduced. There are existing 'buy' signals for the MACD trigger and On-Balance-Volume but longer term stochastics are still in bearish territory