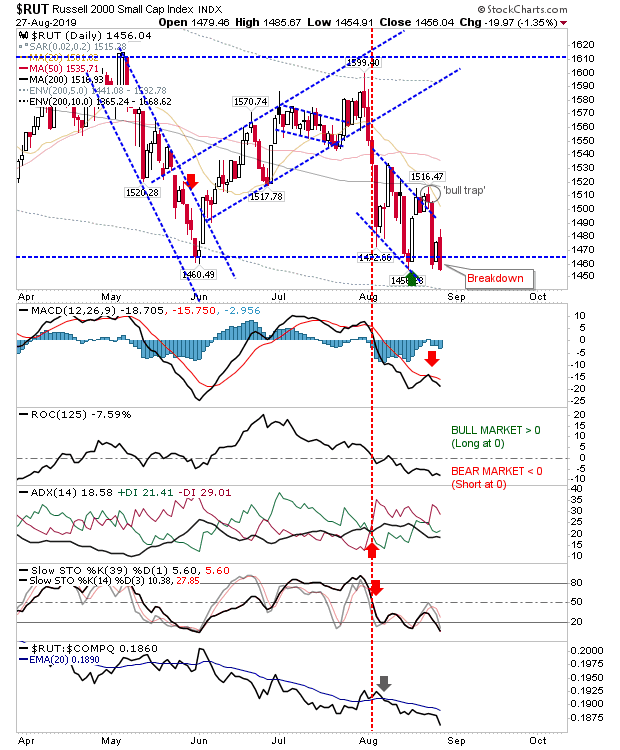

Russell 2000 Takes Plunge Below June Lows As Bears Strike Again

It was a second rough day for indices with the Russell 2000 taking the brunt of the selling. More troubling, what should have been a god bounce off support was swept away by today's bearish engulfing pattern - made all the worse by the recent strong bounce, which has now failed. Technicals are again net bearish for the index. Again, it will be time to look at the relationship against the 200-day MA to give us an indication as to when the indices reach historic extremes; the first such test for the Russell 2000 will be when it gets to 1,441.