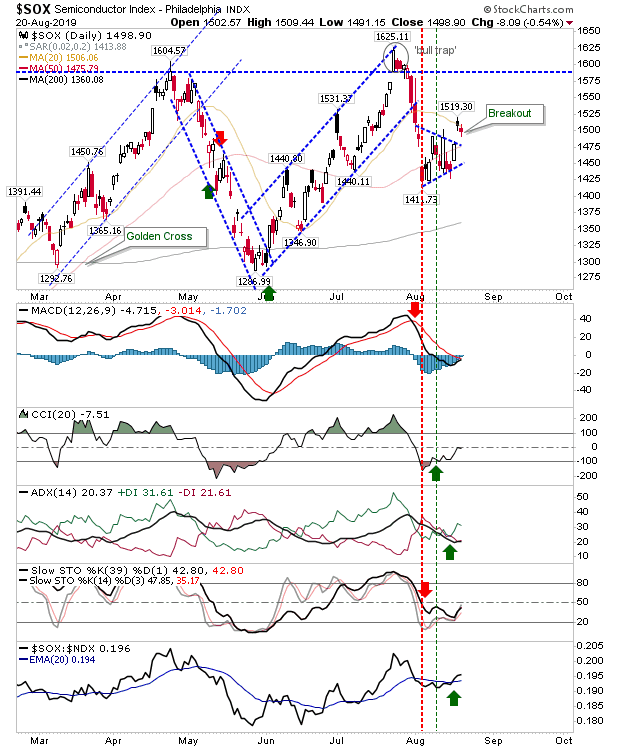

Semiconductors Break Upside From Pennant Consolidation

In attempt to break the deadlock of the recent consolidations, the Semiconductor Index gapped above its pennant. Today's losses didn't close the gap, keeping the bullish move intact - for now. New support is 1,412. The next challenge is 1,605. The relative performance advantage of the Semiconductor against the Nasdaq 100 ticked higher with further gains in the CCI and +DI/-DI