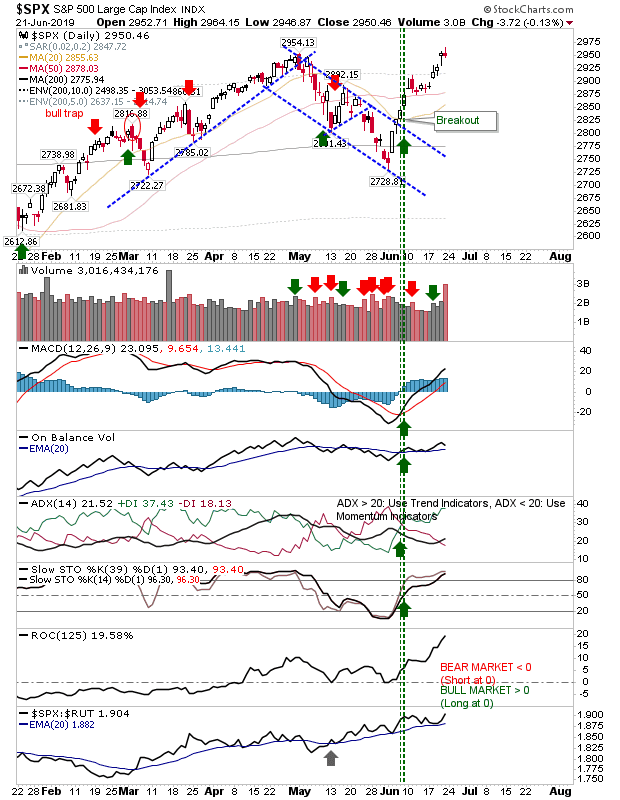

Early Enthusiasm Fails To Hold

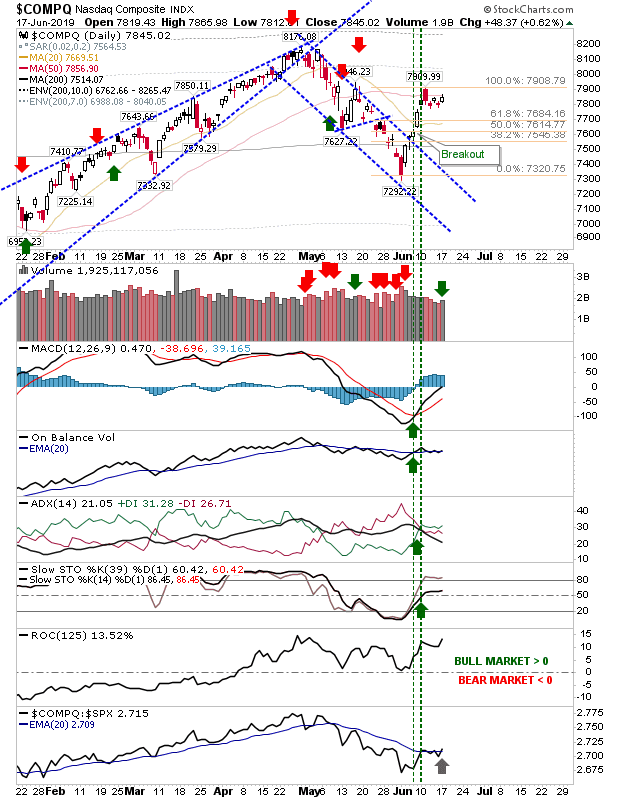

This will be the last post until my return from holidays on July 22nd. Today finished with a bit of indecision as indices closed with bearish 'black' candlesticks; there were strong opening gaps but no follow through with afternoon buying. The risk is for a gap down tomorrow, which would leave bearish 'reversal evening stars'. The biggest gain came from the Nasdaq. The index gapped over 1%, but this gap didn't clear the April high. Volume was reasonable if a little unspectacular. Relative performance against the S&P remained strong.