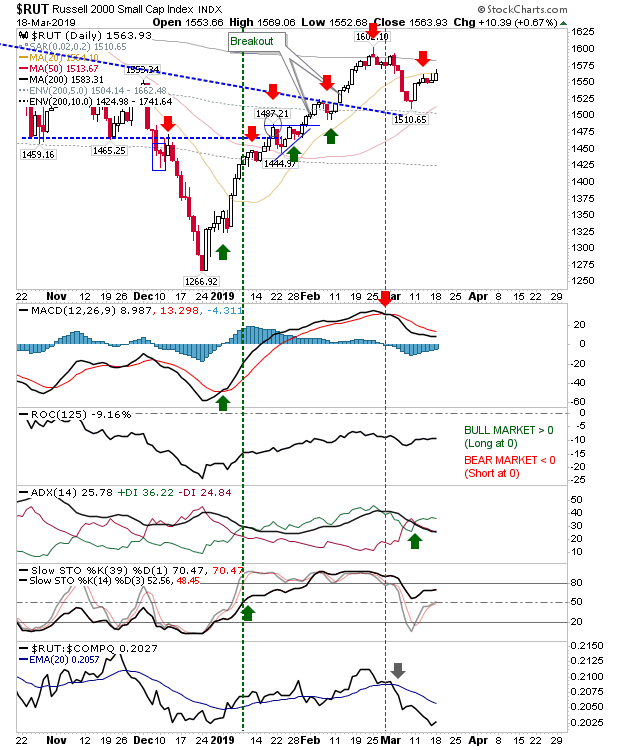

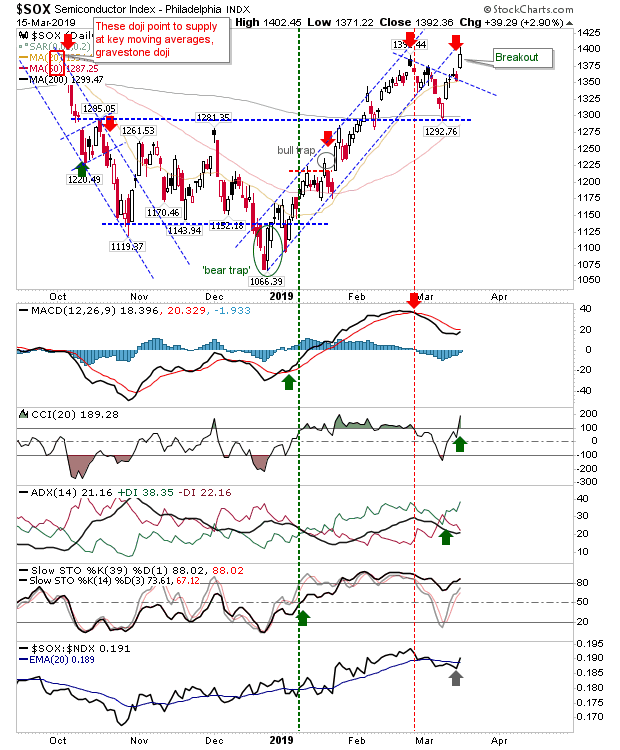

There wasn't a whole lot to today's action. Weakest of the indices, the Russell 2000, may be offering shorts a second bite of the cherry following a rebuff off the 20-day MA, but it was not a decisive reversal. Semiconductors have so far failed to challenge the February high and this weakness may make its way into the Nasdaq and Nasdaq 100 which are faring slightly better. The S&P (along with the Dow) had a quiet day. A very narrow doji following yesterday's 6-month high keeps the rally going and the 200-day MA is there to lend support.