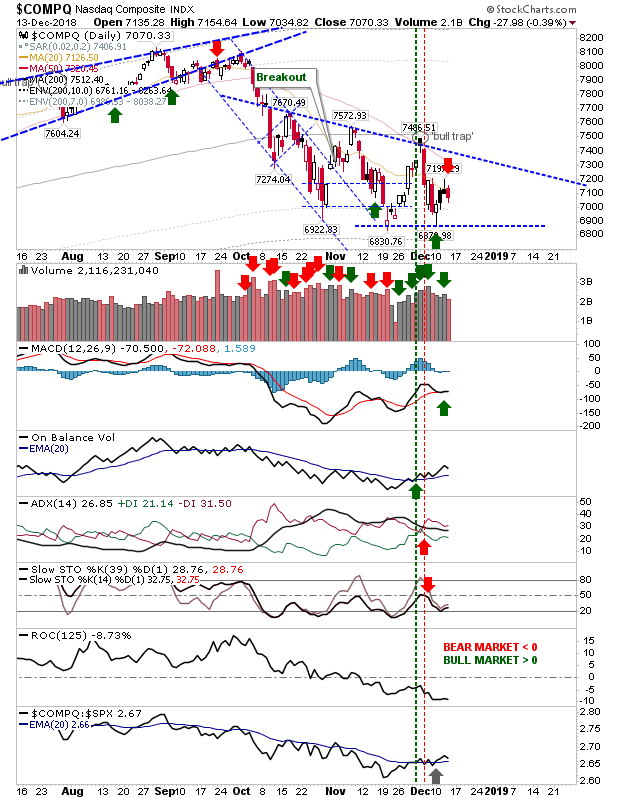

Bearish cover undermines nascent bounce

Since October's sell-off, down days that racked up losses of 3% or more have garnered much media attention, but the action of the last two days looks a lot more bearish than one of those big sell-off days. The Nasdaq posted a small bearish black candlestick on Wednesday, which was followed by a small bearish engulfing pattern today. Given this followed from an earlier bullish hammer, it now looks like this bounce is losing momentum and another push towards sub-6,800 is on the cards. There is an uptick in relative performance (vs the S&P) but I wouldn't be looking for this to last.