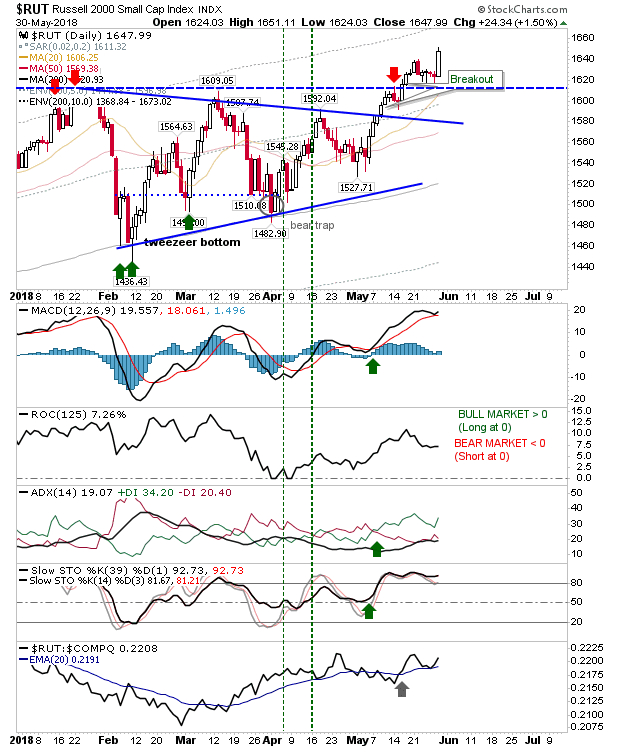

Small Caps Follow Through; 'Bear Trap' in S&P

Yesterday had opened up bearish opportunities in Large Cap Indices but it was the Russell 2000 which ultimately delivered in favour of bulls. The Russell 2000 followed yesterday's successful test of support with a 1.5% gain today. With no overhead resistance and net bullish technicals there isn't any clear point of weakness.