Bulls Make Solid Gains

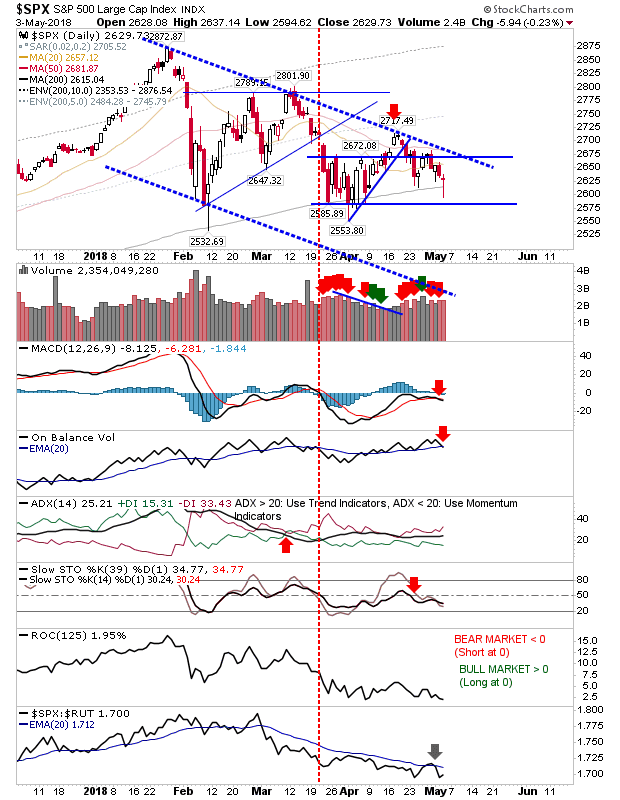

A solid close to the week helped advance Thursday's recovery. Tech Averages had the best of the action. Any short trades should be covered as the nature of the price action has shifted more sideways/bullish. The Nasdaq 100 cleared declining resistance with a new bullish cross in relative performance. There was also a 'buy' trigger for On-Balance-Volume and MACD. Next tests are 6,856 and 7,000.