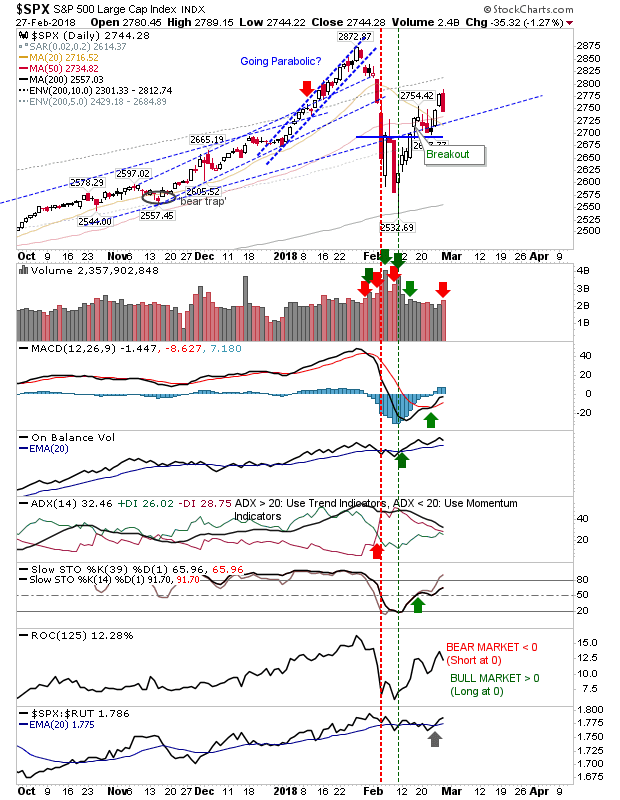

Fresh Distribution

Yesterday saw sellers return with a fresh round of higher volume selling. However, the breakout moves which saw indices clear the congestion of spike highs from last week were not violated so Tuesday's action will not as yet panicked existing longs or buyers of the February swing low to sell just yet. The only exception to this is the Russell 2000 which is struggling to achieve any kind of market leadership. Technicals for the S&P are generally bullish with the index still outperforming the Russell 2000 and the ADX just a small step away from a bullish cross which would be enough to confirm a net bullish picture on the intermediate time frame (i.e. suggesting this rally could go on for another few months).