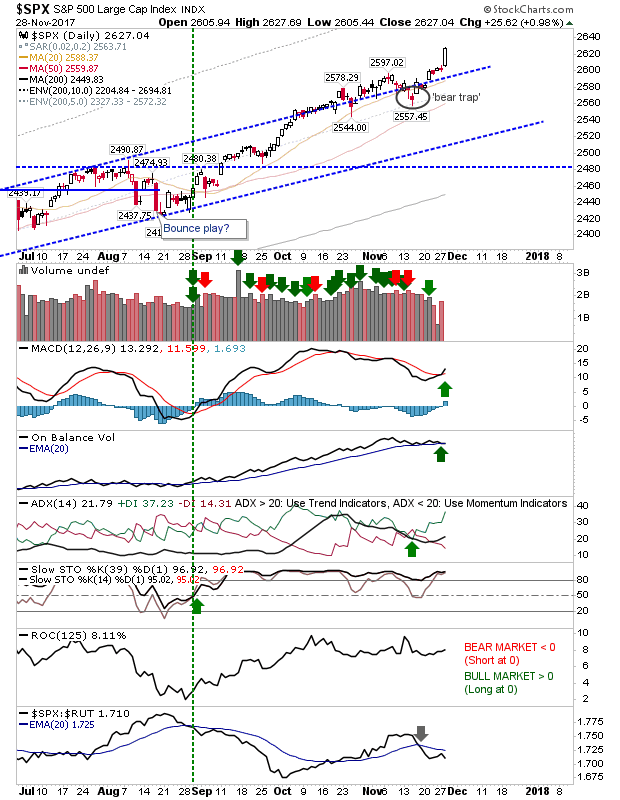

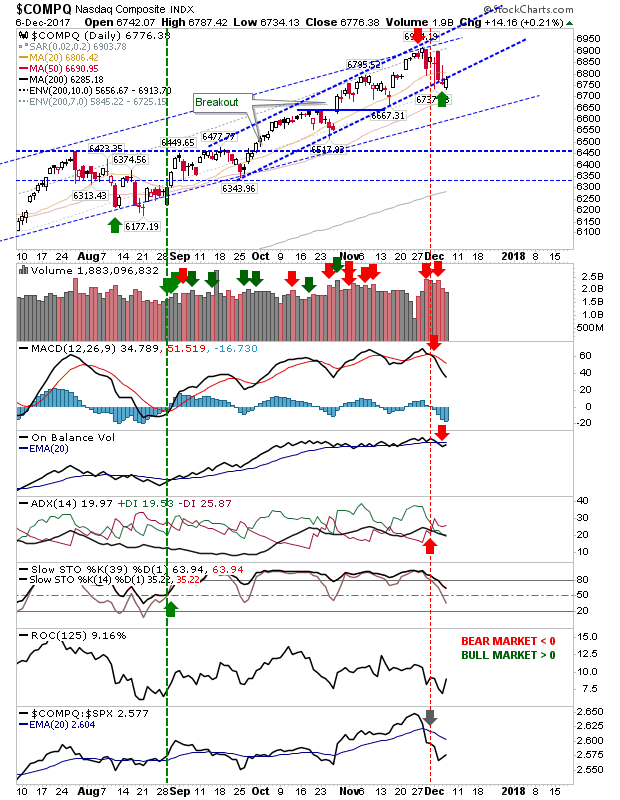

Tech Indices Dig In At Support

It was a relatively quiet day for markets so today was more about the working status of potential trade setups. Tech Indices are still holding to a bullish set up with both the Nasdaq and Nasdaq 100 at channel support having enjoyed small gains today. Stops can go on a loss of today's lows if looking to take advantage of the support test.