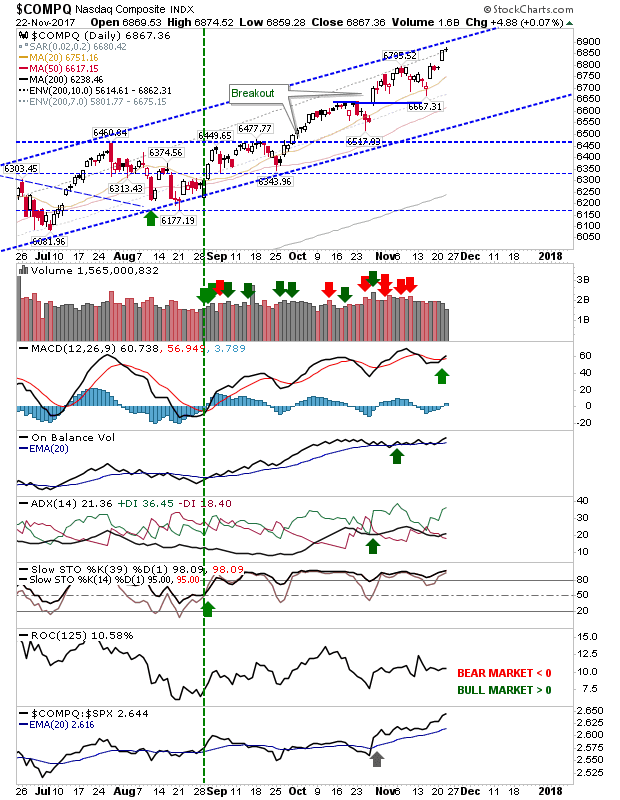

Nasdaq Tags Channel Resistance

The post-Thanksgiving recovery offered some modest profit taking with Semiconductors experiencing the worst of the selling but the Nasdaq tagging resistance before reversing. It offered the clearest 'sell'/profit take trigger after the August support 'buy' signal. Given action in other indices it could break above resistance, accelerating gains, but taking some profits here would be prudent.