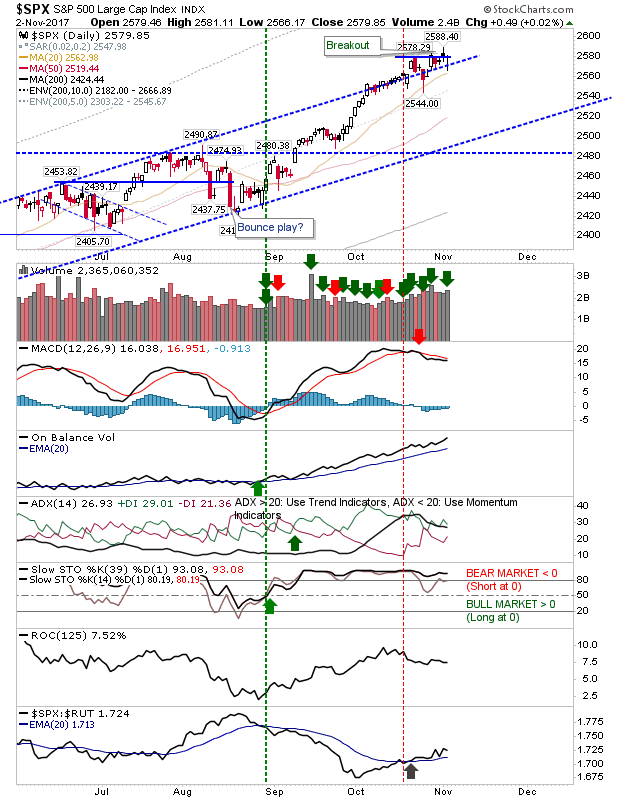

Nasdaq Market and Breadth Divergence

Friday saw a nice little finish for markets with the Nasdaq, Nasdaq 100, Semiconductor Index and S&P all doing well as strong earnings from multinationals keep the rally chugging along. The only index to remain on the outside was the Russell 2000 as it continued to map its 'bull flag'. The S&P reaffirmed its breakout after looking like it had topped out. Keep an eye on the MACD as it sits on the verge of a new 'buy' trigger well above its bullish zero line; On-Balance-Volume is also performing strongly. A pop like it enjoyed in late September would not be surprising.