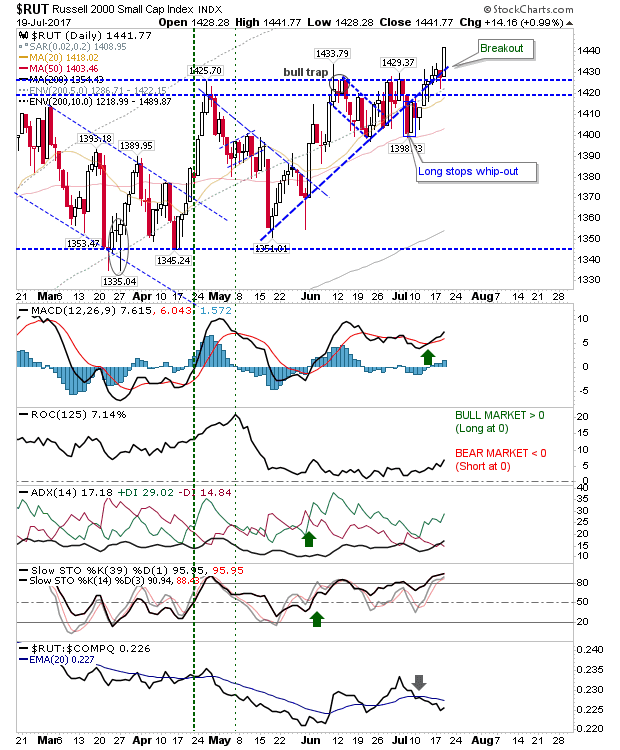

Small Caps Breakout

It has taken a few days for Small Caps to make their move but today was the day the Russell 2000 joined other indices in mounting a breakout. It was a clean breakout supported by positive technical strength - putting to bed the June 'bull trap'. Watch for the second round of stop-whips with an intraday move (and recovery) below 1,430.