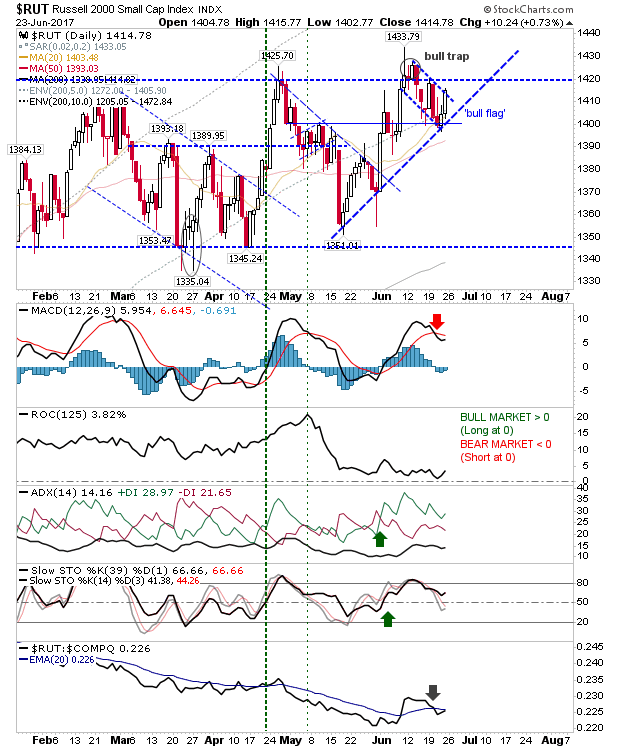

Small Caps Get Their Bounce

The last few months have seen Small Caps trade inside a lengthy sideways pattern but its moment in the shade maybe coming to an end. Today's rally in the Russell 2000 was a picture perfect bounce off rising support. Not only that, it mounted a strong challenge on the early June 'bull trap'. This improved strength has been represented by the continued uptick in relative performance against the Nasdaq. The next watch area will be a new MACD trigger 'buy' to coincide with a negation of the 'bull trap'. Once it gets out of the range it will open up for a new round of speculative investing.