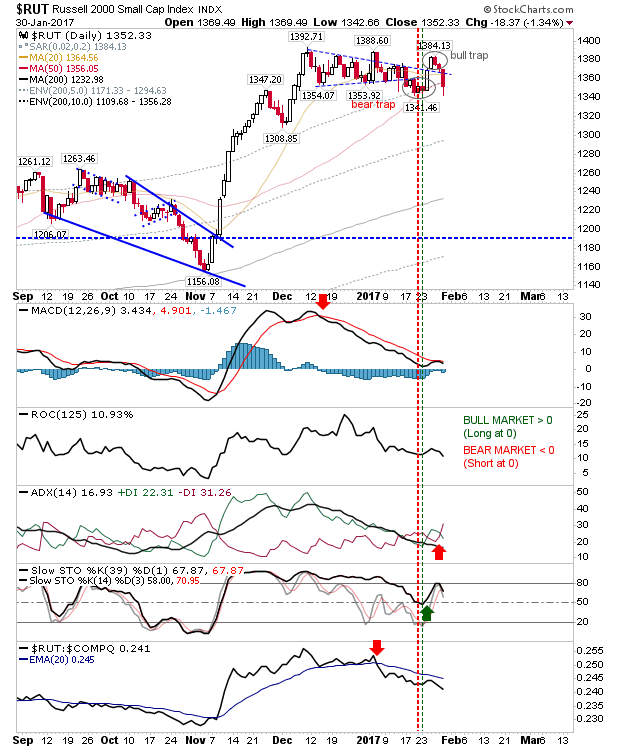

Another Strong Finish For Markets: Russell 2000 Breakout

While volumes have hardly been inspiring, it has been another good week for markets. Best of the action came in the Russell 2000, which has traded sideways since the start of December and didn't kick on after the 'huge' rally following Trump's election. Today's 0.75% gain didn't look like much but it did take it above the previous set of swing highs. It also helped in that it was supported by fresh 'buy' triggers for the MACD, Slow Stochastics and ADX