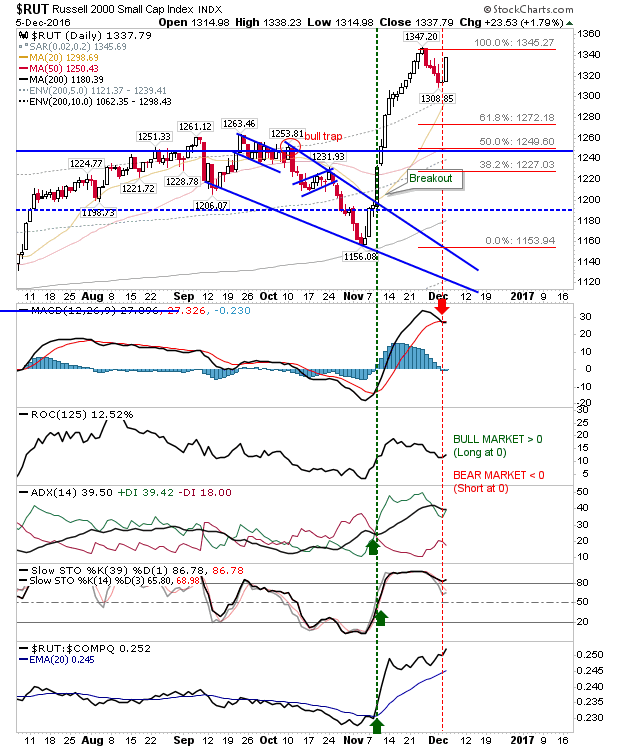

"... One thing though I would like you to shed light on: the price action we see nowadays: 1. Isn't it irrational exuberance 2. How does it compare to 2000 and 2007/08 and 3. In the wake of QEs to date and now promised fiscal stimulus, how large a bubble we will end up creating" Hi Solomon, Thanks for the feedback. [1] The March 2009 low was a 'generational' low for me (i.e. a buying opportunity like this is unlikely to occur again in my lifetime). I have to admit, it came a year early for me - but I think it's a significant low which will stand the test of time. [2] However, the broader market is in need of a significant pullback to mark a cyclical low; one much like in November 2011. The Russell 2000 was the only index to tag this in February 2016 and I think we are seeing the fruits of this now. But all markets have to experience the sell off to definitively put a mark on this. It has been 5 years since such a move last happened so we are (very) l