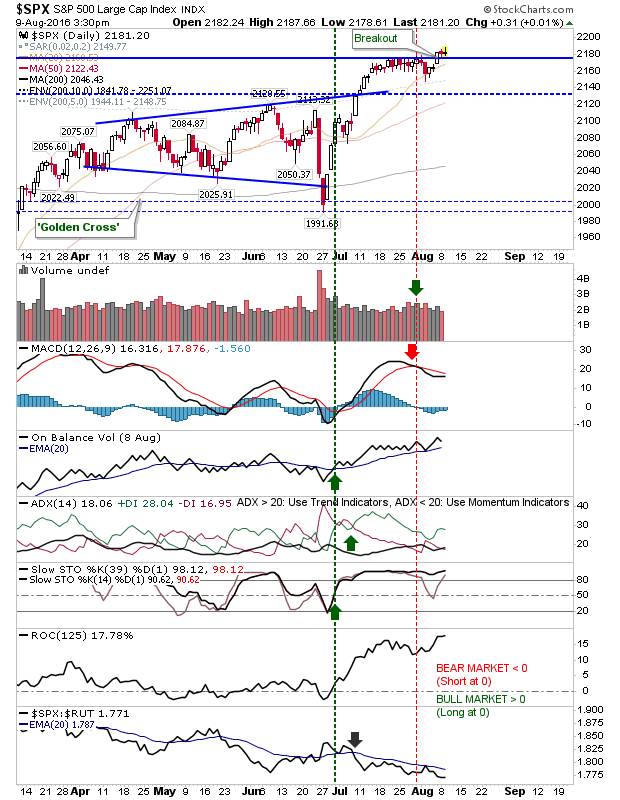

Little To Add

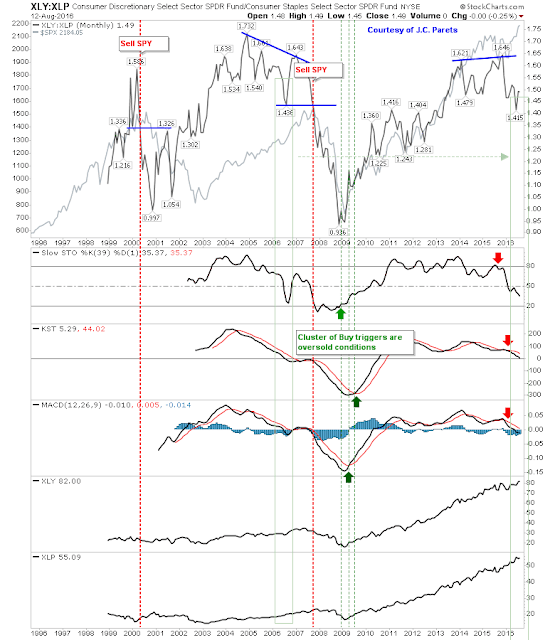

Not much to say after Friday's action. Instead, I will take a look at some of the longer term charts. Of these, bears look to have an edge. The relationship between consumer discretionary and staples stocks has been in a slow decline, which in the past has led to big sell offs, but the market has refused to buckle and is trading in a manner much like it did in 2006. If the latter pattern was to repeat it could be another year before sellers regain control.