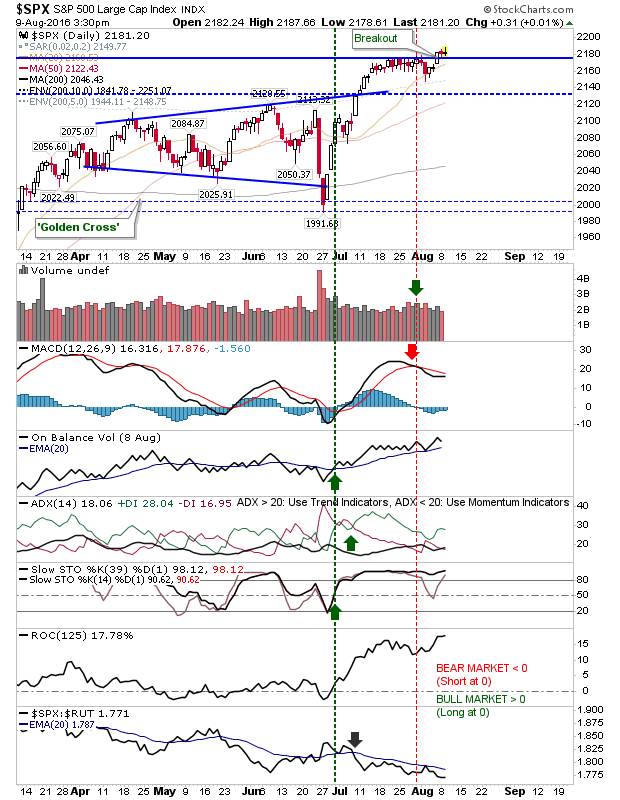

Getting back into the groove with my vacation behind me. Friday's jobs data gave markets a healthy boost into the weekend past to help reverse profit taking from last week. These gains have held for the early part of this week too, although with end-of-summer still a month away it's hard to see where the next boost will come from. Having said that, there isn't a reason to short, and taking some profits wouldn't hurt, but there is no clear sell signal either. The S&P successfully navigated 2,100 in July and is building a new support level around 2,070. Technicals are drifting a little, but from a position of strong bullishness. Relative performance is perhaps the only concern, but this is only because Small Caps are in a more bullish state.