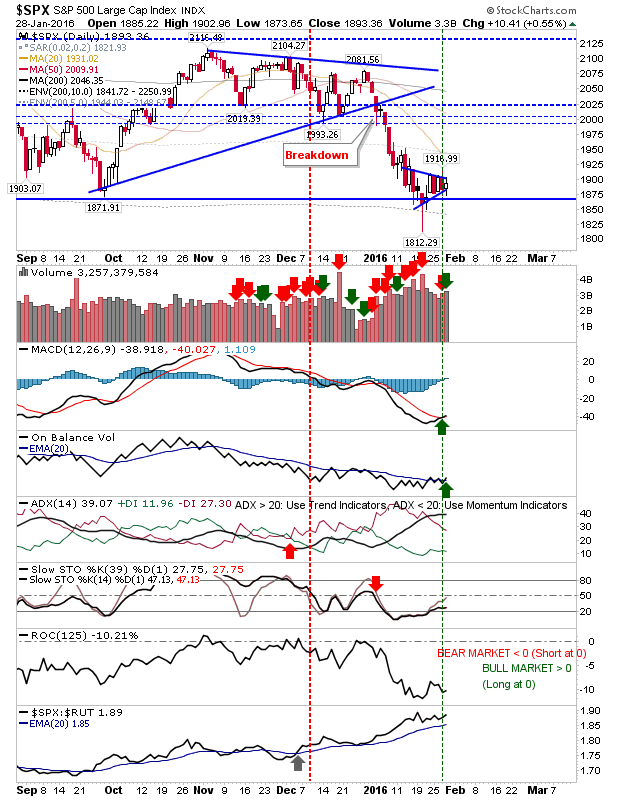

Early Selling Rebuffed

Healthy Action in today's markets as early selling was outdone by afternoon buying. The respectable close will help build confidence of buyers, at least until the November-December trading range is challenged. For the S&P. 2,000 looms overhead, but until this is challenged there is little to add. The Nasdaq closed near today's highs as it sits on the verge of a new On-Balance-Volume 'buy' trigger. The Russell 2000 had only a small gain, but it has the most work to do to rebuild confidence. On the positive front, it's close to a 'buy' trigger in On-Balance-Volume. Another index doing well is the Semiconductor Index. It registered nearly a 1% gain as it looks to recover 2016 losses. Supply doesn't become a concern until 650 is reached. Tomorrow is a chance for bulls to kick on and put further distance on the recent swing low.. Not much more to add until then. Buyers can now look with greater confidence to accumulate pull backs.