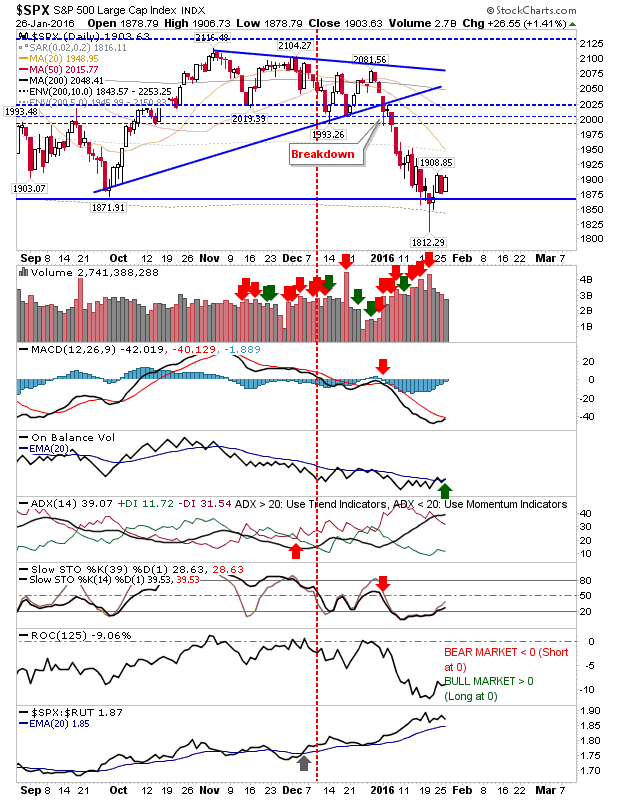

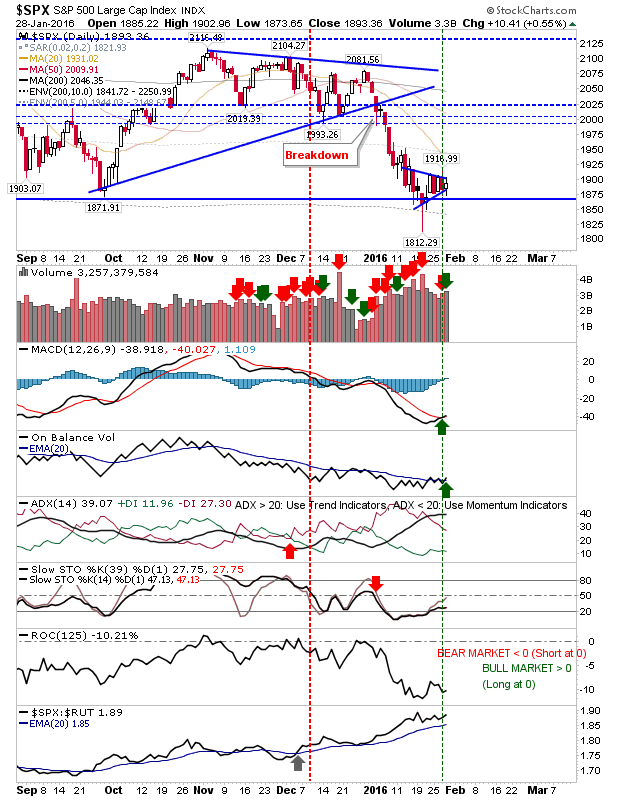

Market Consolidations Continue

The consolidations developing in the market remained in play by the close of today's business. Volume climbed in confirmed accumulation, which is a potential sign for an upside breakout from these consolidations. But with bearish lead-in trends, any upside breakouts will quickly run into supply issues from Christmas consolidations. The S&P is shaping a pennant just above support from September/October swing lows. There is a weak 'buy' in the MACD and On-Balance-Volume.