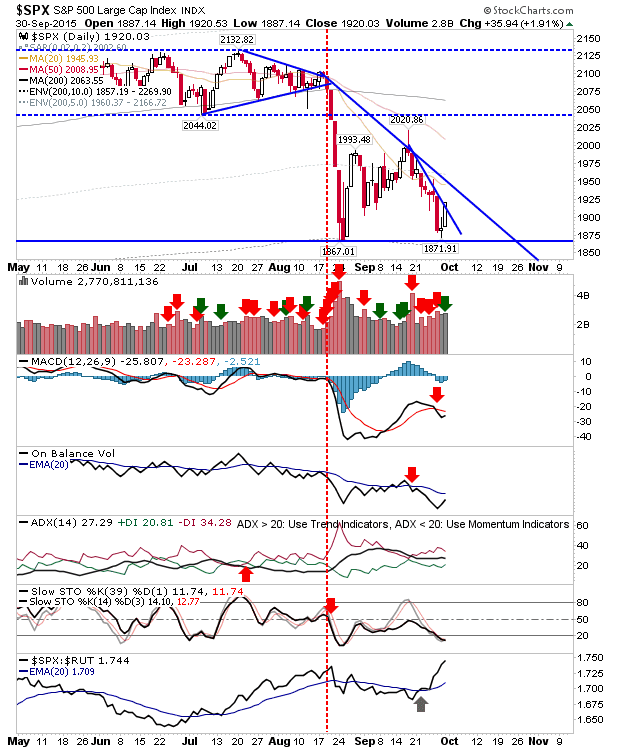

Markets took further losses, but a late rally put a bullish gloss on the day. With the DAX kicking in demand at the August low (not helped by Volkswagen), there is a chance for the S&P to build a swing low here. Volume climbed in distribution, which isn't great, but beats the tepid, nondescript action of yesterday. The S&P hasn't yet triggered a 'sell' trigger in the MACD, but is close to generating a strong 'sell'. Remaining OBV, ADX and Stochastics are in bearish territory. The Nasdaq gained a little ground on the open price and the 'bullish' hammer would offer more if oversold 'stochastics' were in play, which are currently treading the middle ground. The Russell 2000 also finished with a bullish doji. Like other indices, this reversal occurred in a bit of a vacuum, away from logical support. As the index which is experiencing the most relative weakness, it should be watched closely if it's able to regain its mojo. Stre