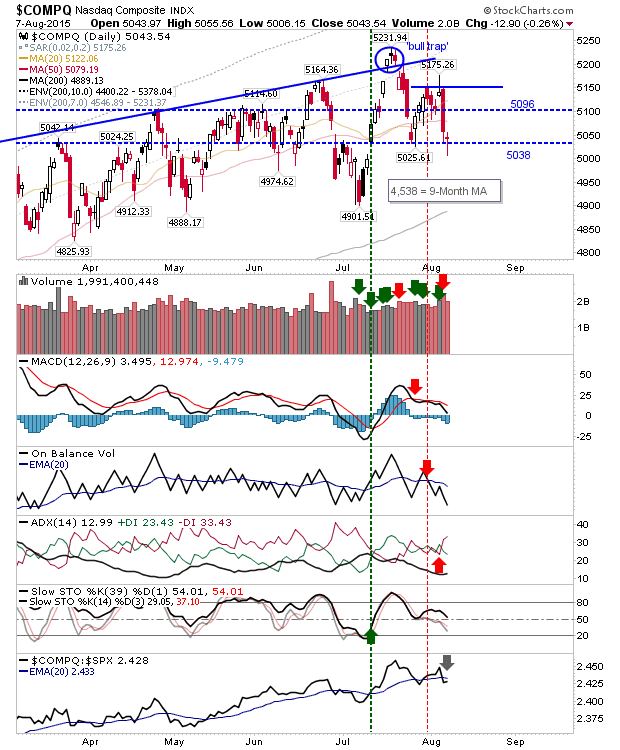

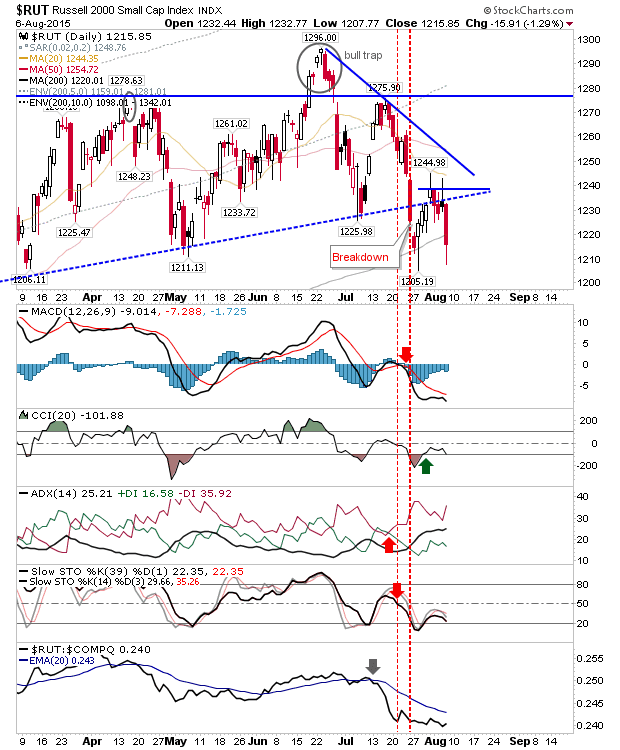

Recovery In Indices

It was a good day for indices, with the S&P rallying off its 200-day MA, and the Semiconductor Index breaking upside from its wedge. The Semiconductor Index closed with a 'Death Cross' between 50-day and 200-day MAs, while the breakout generated some bullish technical signals. The risk:reward remains good, even for a push just to the 50-day MA, and pullbacks will help lower this risk.