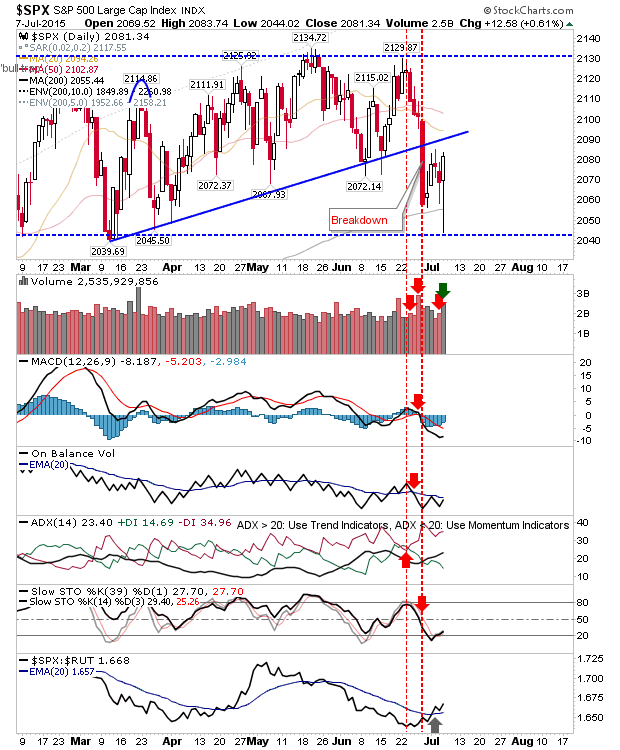

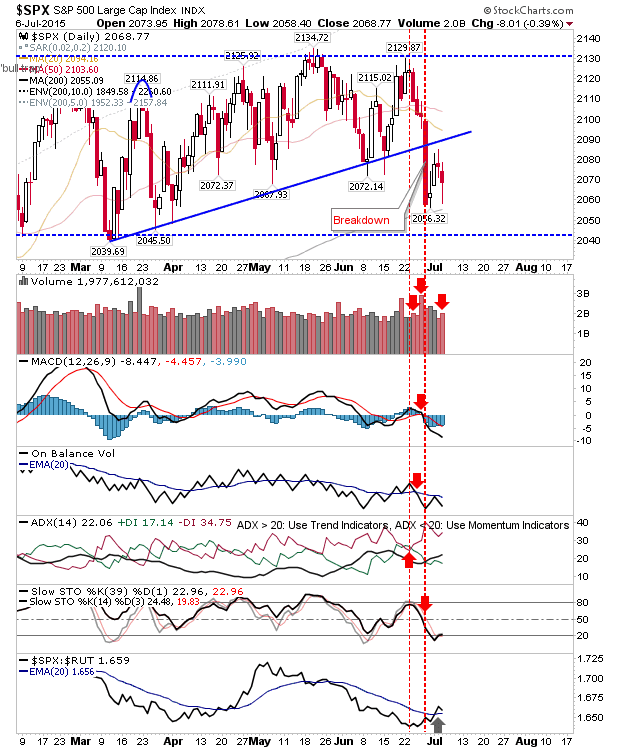

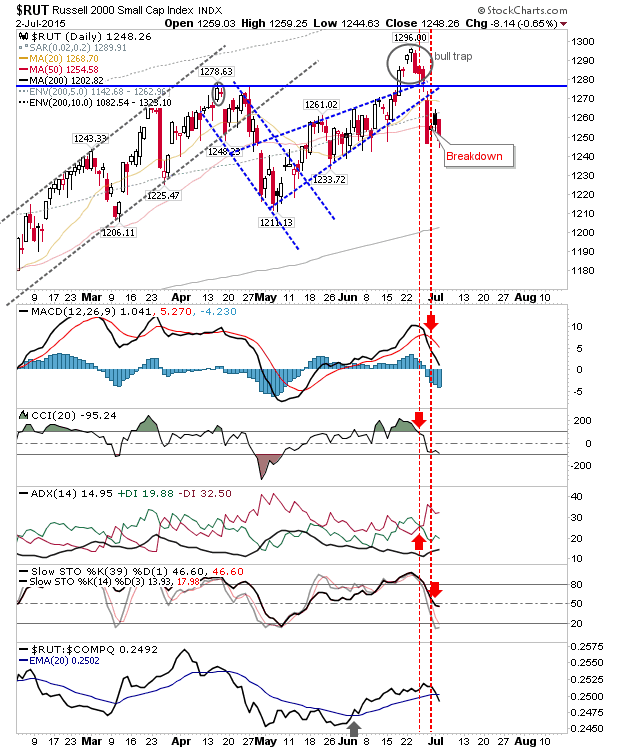

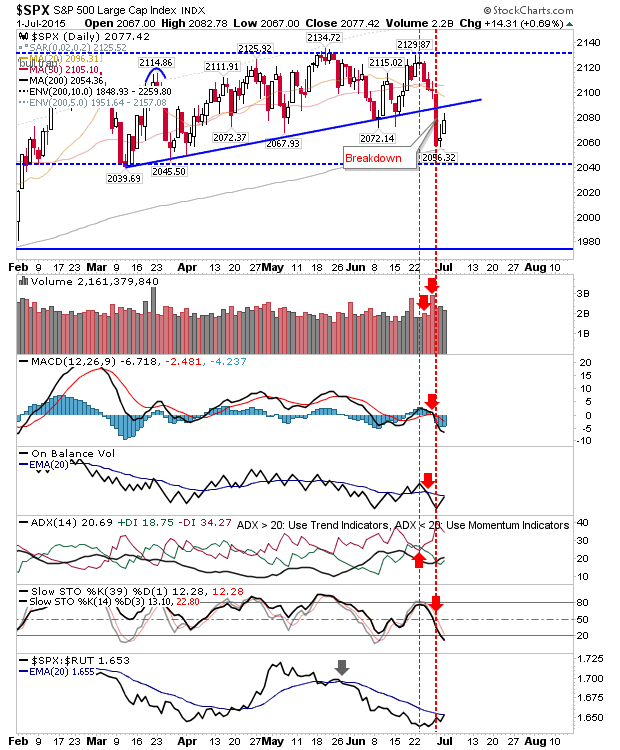

Volatility Picks Up as Gains Reversed

With China vying with Greece for Worst Financial Headline, buyers were hard to find. Yesterday's late surge - typical of capitulations - was completely reversed by today's selling. Where the S&P was knocking on the door of a break of 2085, it instead finished the day below its 200-day MA. It has been a long time since it last trades below this average, but we may be now looking at the start of the capitulation. While losses were big, it maintained its relative strength against the Russell 2000.