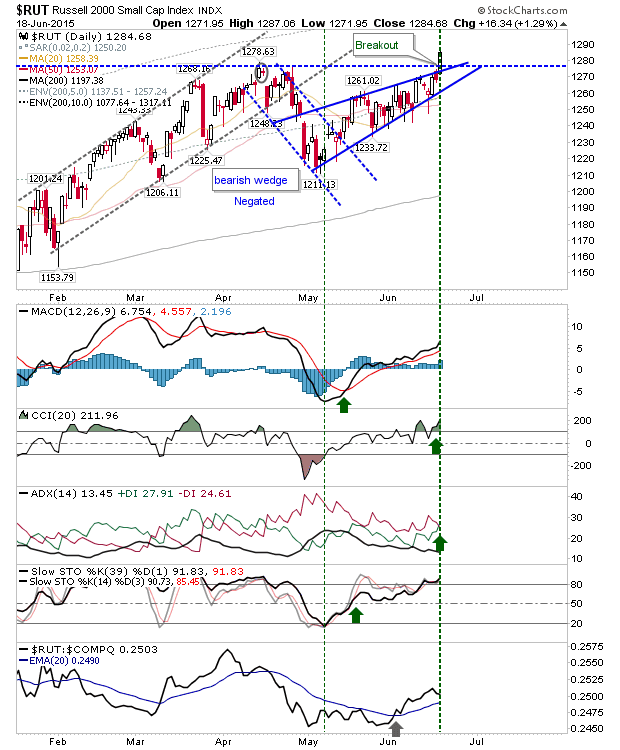

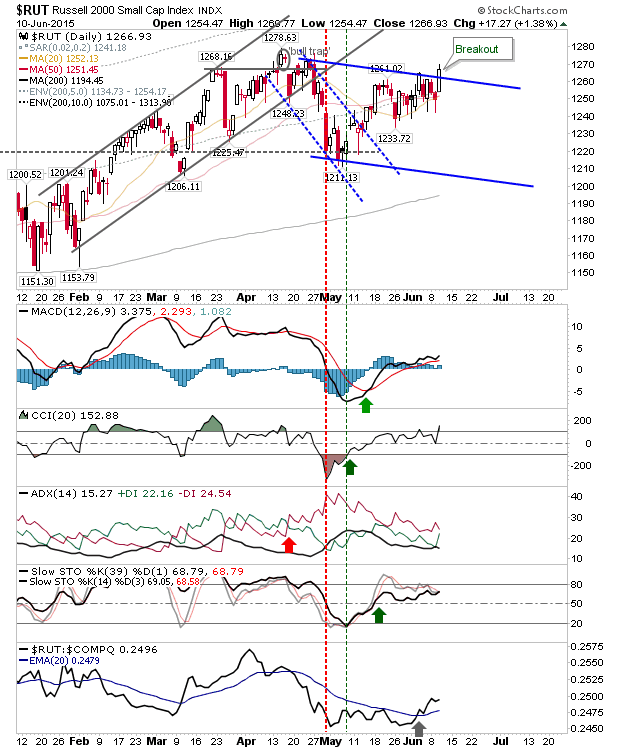

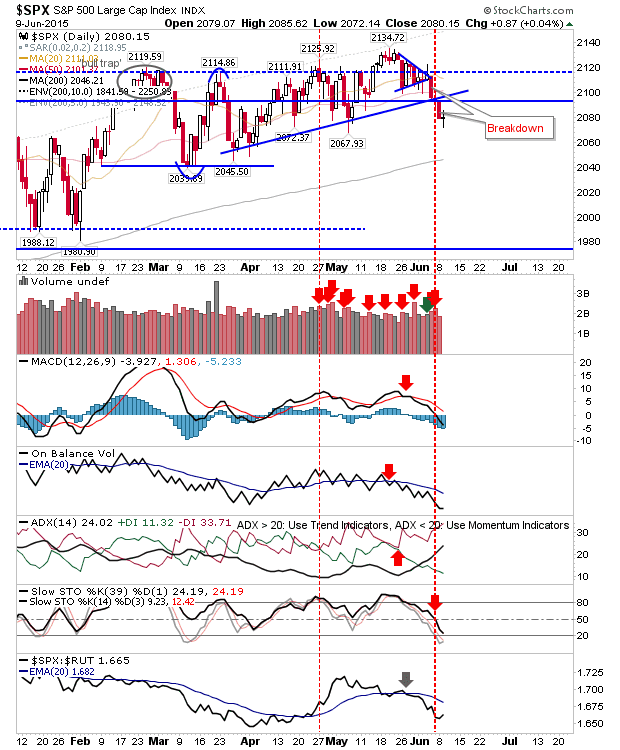

Yesterday's gains in the indices were able to add a little more upside before coming up against resistance. The S&P finished in the crux of former rising support, declining resistance, and the 50-day MA. Volume declined with technicals net bearish. Tomorrow is decision time for the index: break declining resistance and a retest 2,134 opens up, reverse, and a move to the 200-day MA comes into play. The Nasdaq 100 finished at former bearish wedge support, turned resistance. Despite bullish volume accumulation, technicals remain negative. However, the Nasdaq did enough to regain rising wedge support on yesterday's gain, redrawing support and shifting the index back to neutral. Volume also climbed to register as accumulation. The rally in the Russell 2000 is morphing into a bearish wedge and is fast approaching resistance at 1,278. Unlike other indices, it lost a little ground to yesterday. While the index is outperforming the Nasdaq and S&P, technicals lik