Sellers Return

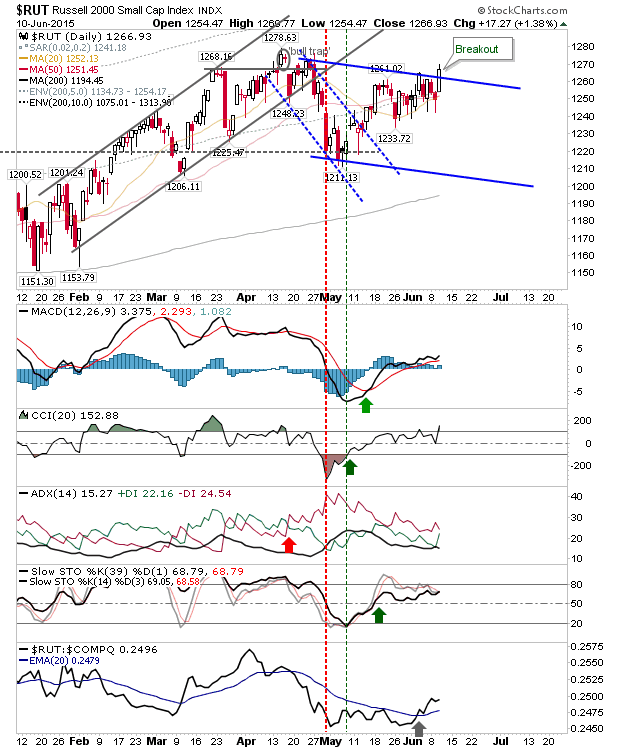

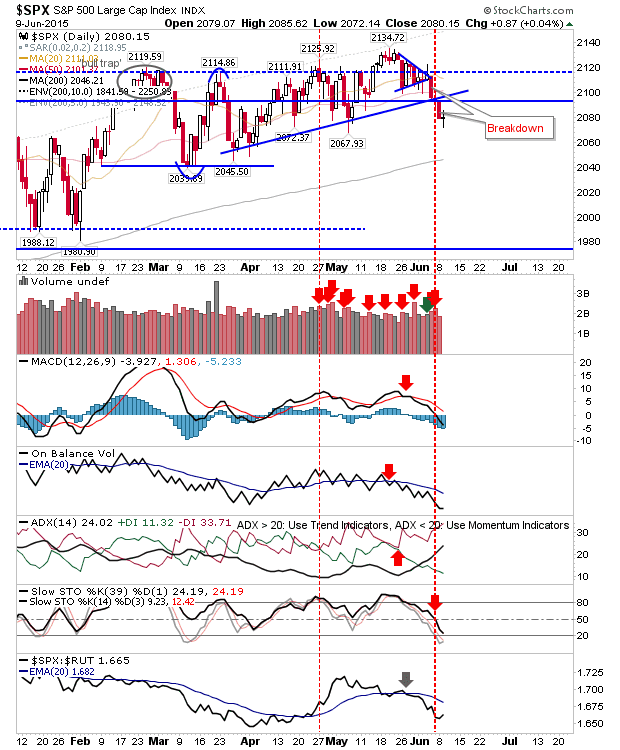

Profit Takers return after a two days of buying. The selling remains confined to broader trading ranges, which remain dominant until breached. In the case of the S&P there is 'bear trap' support at 2,080 and resistance at 2,115 to consider. Friday's action let it in the middle of this range, just below the 50-day MA. Volume was lighter, which weakened the importance of the selling. The Nasdaq is easing back to converged wedge support and 5,038. As with the S&P, trading volume was lighter. Bulls may get some joy with a bounce off converged support with the index close to new all-time highs. The Russell 2000 cleared the tentative downward channel. Friday's action retesting the channel with a neutral 'doji'. Monday could see a drop back inside its channel, but should it do so then the presence of converged 20- and 50-day MA support (1,252/4) could offer the opportunity for bulls to mount another round of buying. If there is an index which