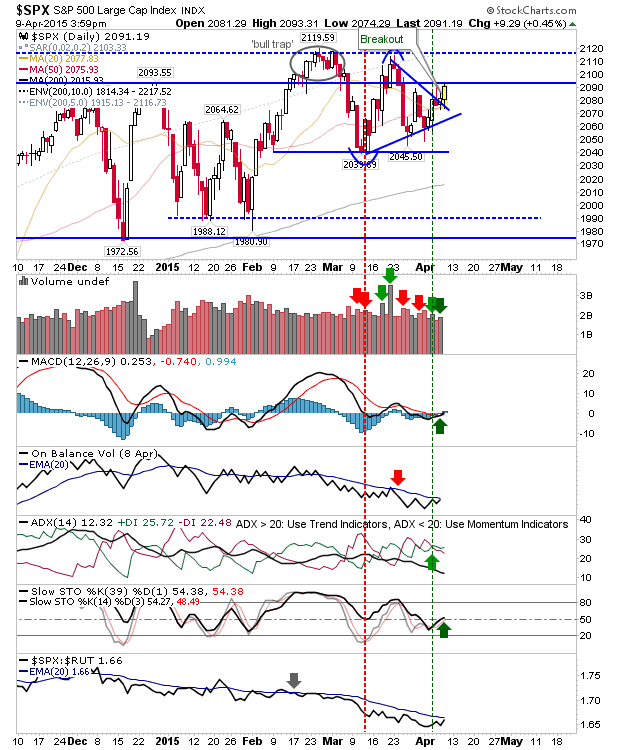

S&P Confirms Consolidation Breakout

Markets are still bound by the larger range from March, but there was a consolidation breakout on offer from the S&P. It still has overhead supply to work with, but today's buying registered as accumulation. The S&P enjoyed a MACD and Stochastic 'buy' along with today's action. However, On-Balance-Volume still has to trigger a 'buy' signal to turn all technicals net bullish.